Today we’ll see how it can potentially turn dead, unproductive investments into new cash flow to power your business or your life. To do this, we turn to another simple formula called the Investment Cash Flow Index.

This is part 3 of a 3-part series. In the last two newsletters we showed you:

- 5 Steps to Safely and Quickly “Cash Flow” Your Way Out of Debt

- How to Use the Cash Flow Index to Quickly and Safely Eliminate Your Debt

By following the steps outlined in those articles you will have liquid cash reserves, extra cash flow, and a roadmap for which debts to pay off first.

Now it’s time to see if you can accelerate things with the Investment Cash Flow Index to create more cash flow from dead assets.

The Story

According to the Economic Policy Institute, the average American household has $95,776 in investments.

And accumulation-based financial planners have drilled into the American psyche that you should NEVER ever touch that money.

“You’re in it for the long haul” they preach.

As a result, many people have tens of thousands, even hundreds of thousands of dollars locked up in “dead assets” that could actually be helping them create real, sustainable, and predictable cash flow instead.

And as you know by now, sustainable cash flow is the key to reaching economic independence as quickly as possible.

Why Should I Care about the Investment Cash Flow Index?

As we showed you last time, we’ve discovered over the years that a cash flow focus always wins over an accumulation-based financial philosophy.

What accumulation-based financial planners often don’t tell you is that as long as your money is invested in their company’s funds, they continue to get paid on Assets Under Management (AUM).

But when we rise above the smog of “accumulation” bias, we see a much clearer cash flow picture.

And the fact is, sometimes it is financially smart to cash out an inefficient investment and use it to pay off an inefficient loan. The net gain to you is more cash flow.

Is it something you should always do? No, not necessarily. That’s why it’s important to have a financial team who can look at ALL of the potential side-effects of your financial decisions.

However, the first step in gaining clarity is to see which investments are efficient and which ones are duds. That at least gives you a great head start to making great financial decisions.

In this article, we’ll take a look at a simple scoring system called the Investment Cash Flow Index. The Investment Cash Flow Index (IFCI) objectively shows you which investments are cash-flow inefficient.

We’ll look at the formula itself, and then walk through a few examples to see exactly how this can help you increase your wealth much more quickly.

How Does It Work?

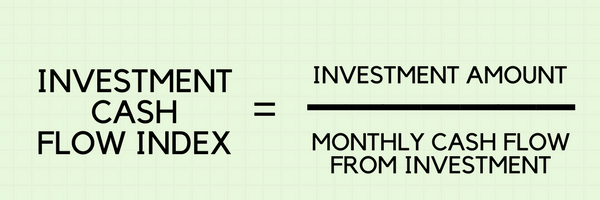

To determine the Investment Cash Flow Index of your individual investments, run your entire portfolio through this simple formula:

Investment Cash Flow Index = Investment Amount / Monthly Cash Flow from Investment

Unlike in the Cash Flow Index that we looked at last week, the closer to zero your Investment Cash Flow Index is, the better off you are.

So in this case, a low number is good.

A high number means the investment is highly inefficient as far as cash flow is concerned. Remember, we focus on cash flow because it’s predictable and measurable.

If an investment doesn’t create cash flow, it is speculation. That doesn’t mean it’s bad, necessarily. But it’s definitely not something you can be certain about.

The Wealth Factory way embraces the economic value of certainty, and that’s what cash flow investments provide.

It’s what the ultra-wealthy use to win the money game, so it’s what we like to use too. Plus it adds safety and reduces risk.

Some Common Examples

So let’s take a look at some typical example investments and calculate the Investment Cash Flow Index for each:

Mutual Fund:

Invested: $100,000

Asset Value: $105,000

Monthly Cash Flow: $0

Investment Cash Flow Index: ∞ INFINITY ($100,000 ÷ $0)

Important note: An “investment” that doesn’t produce any cash flow has an Investment Cash Flow Index of infinity, which means it’s speculation. Even if you have an unrealized capital gain, that does nothing for your cash flow.

Now you may have reasons to hang on to speculative investments and we don’t have time to go into the pros and cons of that here. But our general rule is that if an investment doesn’t cash flow, it is a dead asset and should be open to consideration for cashing it out. Then that money can be redeployed in a more efficient, predictable way.

Dividend Stock:

Invested: $35,000 (1000 shares paying $0.24 per share quarterly)

Asset Value: $34,000

Monthly Cash Flow: $80

Investment Cash Flow Index: 437.5 ($35,000 ÷ $80)

Rental Property:

Invested: $50,000 (down payment, financed the remainder)

Asset Value: $200,000

Monthly Cash Flow: $1000

Investment Cash Flow Index: 50 ($50,000 ÷ $1000)

Small Business (or practice):

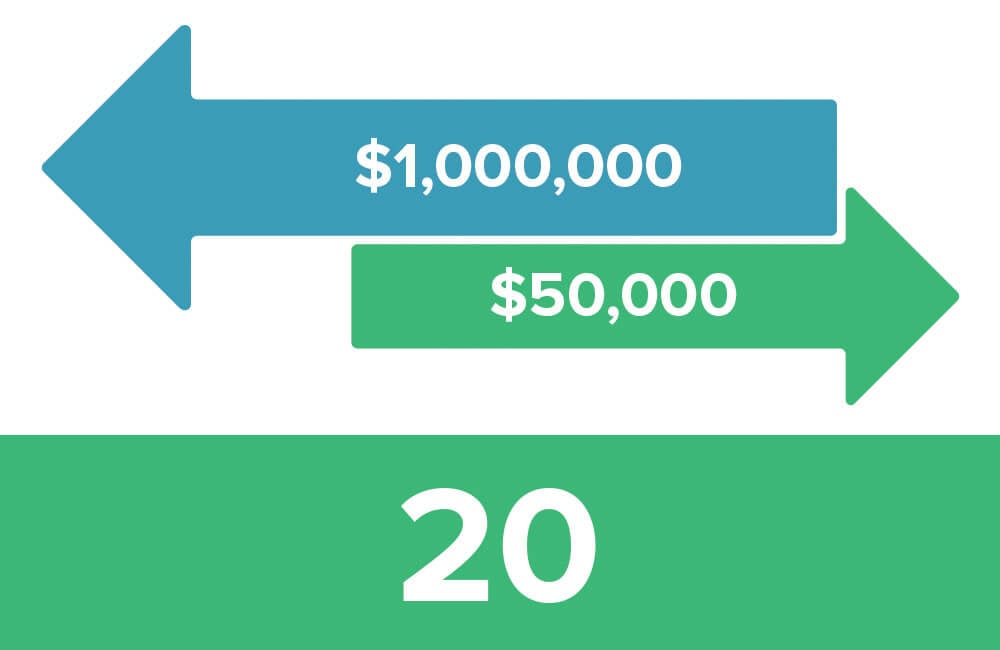

Invested: $1,000,000

Asset Value: $1,250,000

Monthly Cash Flow: $50,000

Investment Cash Flow Index: 20 ($1,000,000 ÷ $50,000)

As you can see, the business has the lowest number. This isn’t always the case, but in many cases it is. Which is why we often suggest that investing in your own business is your best investment ever.

The rental property is also fairly efficient at 50 — so even if you are not a business owner, you can still find efficient, cash flow investments outside the stock market.

The dividend stock is not very efficient, but at least it cash flows (and to be fair, it can become much more efficient over time, especially if you reinvest dividends at first).

But the mutual fund with no cash flow is ultimately a dead asset. You are speculating that it will make some capital gains. Maybe it will. Maybe it won’t. The problem is you have no certainty and no way to plan ahead.

So what can you do?

Creating Cash Flow Out of a Dead Asset

In many cases, it may make sense to cash out highly inefficient investments (with a high index) and use the proceeds to pay off or pay down inefficient loans (those with a low index).

Most people chafe at this idea. They like the “security” of seeing a big positive number in that investment account.

But a cash flow focus tells us that overall, it’s an inefficient use of our money.

Let’s go back to the example above.

Let’s say you cash out the $100K in a mutual fund that hasn’t been earning any cash flow.

Instead, you could then use it to immediately pay off inefficient loans.

Imagine you had an inefficient credit card debt that is costing you a perpetual $500 a month just to keep treading water.

By paying that off immediately with a dead asset, the $500 monthly amount you had been paying is now freed up as new cash flow.

You can use that extra cash flow to pay down the other loans more quickly. Or, if your remaining loans are already efficient, you could instead use that $500 per month to buy new cash flow investments. Or reinvest it in your business (or whatever current investment has your lowest Investment Cash Flow Index).

This is just a small example, but these kinds of efficiencies have a multiplying effect on your wealth over time.

There’s a lot more we can say about this, and these are the types of scenarios our Accredited Network providers help our top clients with on a 1-on-1 basis.

CAUTION: Cashing out an investment to pay off a loan can be very efficient, but may have other effects on your overall financial blueprint. It’s best to consult a Cash Flow specialist or your own wealth team to make sure you understand all the implications.

Fortunately, the math is so simple that you can run these numbers yourself just to get an idea of how efficient your existing loans and investments are beforehand and then take the numbers to your financial team.

What To Do Next

Determining which investments are efficient and inefficient is the first step in building a rock-solid investment portfolio that automatically propels you forward to reach economic independence as fast as possible.

With that in mind, here are your action steps to consider today:

- Run the Investment Cash Flow Index formula on all of your investments.

- Rank each investment in order, from most efficient (lowest number) to least efficient (highest number).

- Consider cashing in any dead assets (ICFI of infinity) or investments with a high index. You may want to talk to a Registered Investment Advisor and/or your wealth team to run through all the ramifications.

- Use the proceeds to pay down inefficient loans or make new cash flow investments in alignment with your Investor DNA. Check out these resources for more guidance: Maximize Your Investment Performance by Focusing on Cash Flow and How to Reduce Risk, Avoid Losses, and Boost Returns by Tapping into Your Own Investor DNA.

- If you don’t currently have a wealth team, you can apply here to see if working with our Accredited Network team makes sense.

Until next time…

Build the life you love,

The Builders at Wealth Factory

What is Living Wealthy Weekly?

Each week we share timely trends, news stories, and current events that affect your life. We help you see the impact, personally and socially, and give you possible solutions to avoid any negative effects. We also give you additional links and resources if you want to investigate further. The purpose is not to be the last word on any topic. Rather it’s to help us all stay informed of what’s going on in the world without letting those events negatively impact your lifestyle. Our goal is to help us all live richer, fuller lives from a position of financial strength. This allows you to weather economic hard times, and seize whatever new opportunities arise in our changing world.