Do you want to save on taxes and grow your business?

First, ensure the success of your business by hiring the right expert help.

Then, at tax time, use the cost of those hires to instantly cut your tax liability.

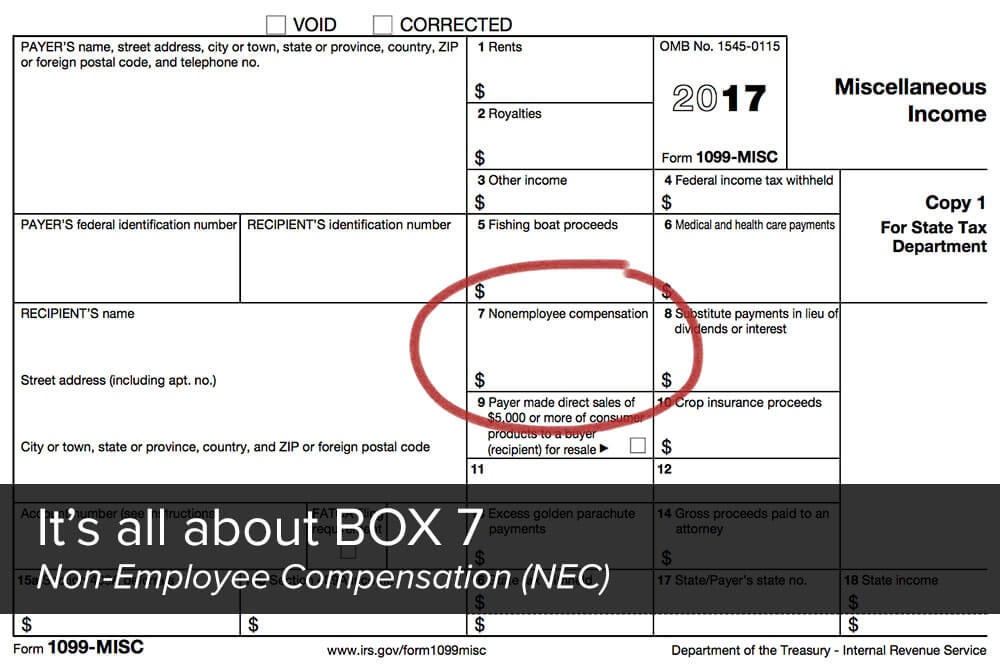

All the magic happens on IRS Form 1099.

(Form 1099-MISC to be precise. Apart from the W2, it’s the most-used IRS form for reporting income.)

While you’ve probably encountered this form during your career, you may not have considered how powerful all of its benefits can be.

We’re going to show you a completely new way to think about 1099s, as well as a few tips to save even more.

“Tag” You’re It—Now Tag Someone Else

Start with any 1099s you’re due to receive (if any) and total those up.

You owe the IRS for the full amount of liability on that total… until you lower it with your business expenses.

The 1099s you send to other people are the easiest and most effective kind of expenses to deduct, because you’re simply passing the tax liability right along to someone else.

Done right, it’s almost like a game of “tag.”

Businesses instantly reduce their tax liability when they send you a 1099—and then you instantly reduce your own liability when you turn around and “tag” someone else.

That’s why it’s essential to make sure you’re sending the appropriate 1099s to the self-employed people who’ve done work for you.

(Important: this includes the knowledgeable experts who can give your business an edge.)

You get the full benefits of expert help, plus a nice bonus when you remove the entire cost of their help from your final tax bill.

The IRS requires you send a 1099 to any person or business who:

- Was paid at least $600

- Performed a service for your business (or professional self)

- Didn’t work a regular schedule under your supervision

- Didn’t have taxes withheld

All of these need to apply.

In an ideal world, you should also have the person or business fill out a W9 (the IRS form that officially asks for address, tax number, and withholding status) and send you an invoice.

You may also want to have individual professionals sign a written agreement that designates him or her as a non-employee contractor.

You never want to surprise someone with a 1099—the relationship should be clear from the beginning.

Pro tip: you can issue someone a 1099 the moment you conclude business. Just send it along with your final payment. There’s no need to wait until the end of the year.

As with any tax issue, anticipating all of this ahead of time makes the entire process much easier.

Scour Your Expenses

Here are four situations you may not have considered:

- WEB DESIGNER—In the Internet Age this can be a big one. If you use your credit card to pay for a standard web service in a transaction that gets a receipt, chances are that’s just an expense (which you’ll still want to file on your Schedule C). But if you “do it yourself” and hire a web designer, stating what you want and then paying one or multiple checks, that person is a contractor who should receive a 1099.

- PHOTOGRAPHER—Custom professional photography is expensive, and if you hire someone to take portraits or other photos for your business, this is typically done on a contract basis. Note that most of the time you’ll be signing a contract prepared by the photographer. Make sure to get a W9 and send a 1099 with your payment. (There’s an exception to this if the photographer has sold you the photos as a product. You’ll know the difference if you are charged sales tax and there’s no contract, and you’ll just list this on your tax return as a normal expense.)

- TALENT—The singer you hire for an event, the actor you hire to pitch your product, and the keynote speaker you hire for your conference… all of these people are contracted talent professionals who should receive 1099s.

- EVENT / PROJECT HELP—You need to be more careful with this one, but many event or project helpers work on a contract basis and are eligible for a 1099. Caterers and tent companies are easy ones to identify—they’re used to receiving 1099s. If your event is a one-off and you’re not directly supervising a helper’s task, then it’s also safely a 1099 situation. (Things get murkier when you hire seasonal or other part-time help, since those workers are usually considered employees. Same goes for anyone directly supervised by you. You’ll want to verify the status of these workers with a tax professional.)

If you didn’t hire any of these people in the last year, you may want to consider doing so in the future.

What to Do Next

Think of this as your golden opportunity to hire your way to success.

Regardless of your business or field, you can often save a tremendous amount of time and money by hiring an expert to help you do it right.

Writing a book? Hire a researcher.

Nobody paying attention to you? Hire a promoter or public relations agent.

Wasting time planning trips or handling logistics? Hire a travel agent. (Yes! They still exist and are still relevant.)

Trying to break into a new market? Hire a language instructor, translator, or cultural attaché.

Losing your edge? Hire a career or life coach.

Unexpected problem holding you back? Hire a “fixer” who has the experience to solve it.

There are endless ways to improve your business or professional self by hiring the right people to help you excel.

And all of them come with the bonus of an instant reduction on your tax liability when you hand them a 1099.

The moral of the story is this: unlike most of your expenses, you’re essentially paying these experts with tax-free money.

And since most entrepreneurs pay a tax rate of 23%, it’s like you’re getting a huge discount on anyone you hire.

Here at Wealth Factory, we often share important strategies for saving money and reducing your taxes (like this noteworthy article by Garrett Gunderson that reveals four “tax-saver” secrets).

But smart spending is just as important—ultimately our focus is on pointing you to rewards that far exceed their cost.

Hiring the right expert can be one of those.

Build the life you love,

The Builders at Wealth Factory

What is Living Wealthy Weekly?

Each week we share timely trends, news stories, and current events that affect your life. We help you see the impact, personally and socially, and give you possible solutions to avoid any negative effects. We also give you additional links and resources if you want to investigate further. The purpose is not to be the last word on any topic. Rather it’s to help us all stay informed of what’s going on in the world without letting those events negatively impact your lifestyle. Our goal is to help us all live richer, fuller lives from a position of financial strength. This allows you to weather economic hard times, and seize whatever new opportunities arise in our changing world.