The 6-Step Guide For Small Business Owners To Help You Build Lasting Wealth

Making sure you keep the money you make is critical for building lasting wealth. And for a growing business owner, it’s hard to do without a team. Because the fact is, far too many business owners end up losing money because they’re missing a key member on their financial team. So let me ask you…

“How many people do you have on your financial team?”

Most entrepreneurs I work with give me one or two names. A CPA, and maybe a lawyer or a financial planner. That’s it. Do you want to know how many professionals I have on my financial team? I have 14. Each of them has a specialty, and working together, they help me keep more of the money I make. They also keep me from making stupid mistakes, and allow me to stay productive so I can make more money.

How many people should you have on your wealth team?

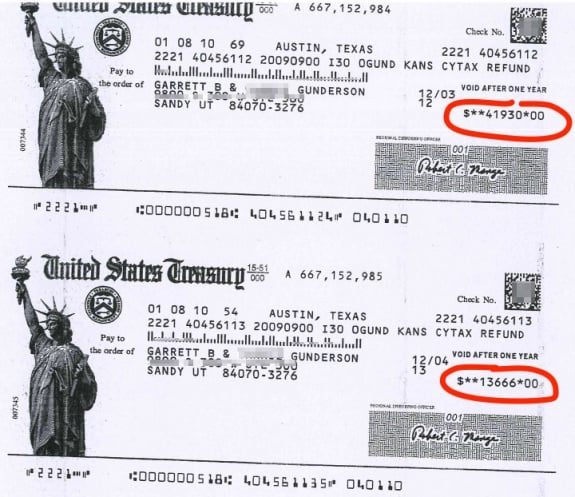

Now, do you need 14 individuals on your wealth team like I have? Maybe not. But the odds are that you have outgrown your current team. Especially if you’ve been in business for more than a couple years. Because as your business grows, so do your financial needs. Here’s an example from my own experience. For the first 6 years I was in business, my CPA was nothing more than a glorified tax preparer. He did a good job categorizing my income and expenses, but he never gave me any strategic advice. After that, I found a CPA who provided me with new proactive tax strategies every year. This one simple change to my wealth team put thousands of dollars back in my pocket each year. And then, once I started making a significant amount of money, I got a second opinion from a Tax Attorney. The result was yearly tax savings in the tens of thousands of dollars. I was even able to go back and recoup $55,596.00 that I overpaid in tax over the previous three years.

(See the picture below of the IRS refund checks I got after adding a Tax attorney to my team.)

Replacing people on your financial team

Replacing someone on your financial team can be nerve-wracking. But it doesn’t have to be a negative experience. It’s just a natural part of growing — just like a child outgrowing a favorite toy. In my case it wasn’t that my first two CPAs were bad. They served a purpose at different stages of my career. The first was a college classmate. He was a good friend, but he wasn’t trained in finding tax strategies for small business owners. When I replaced him, he understood that I had outgrown his level of expertise. The second CPA was great at coming up with new tax strategies for my business. It just wasn’t his specialty to figure out the advanced tax strategies the Tax Attorney eventually came up with.

Your growing financial needs as a business owner require multiple financial specialists

Think of it this way. You may love your family doctor. You just wouldn’t ask her do open heart surgery on you. If you need heart surgery, you get a specialist. And here’s what really important: you get the best results when they are all team players, coordinating with each other and working together on your behalf. In fact, that’s exactly how the ultra-wealthy do it. I even witnessed it first hand.

How the ultra-wealthy do it

When I was 22 years old, I was shadowing a guy named Vince who was one of the best financial minds in the world. We walked into a “family services” financial firm in New York City. This is the kind of firm that only caters to the ultra-wealthy with a net worth of at least $50 million. The client was sitting at a big table in the conference room. Around the table were were attorneys, accountants, cash flow specialists, fiduciaries and investment advisors. Every kind of insurance professional you could imagine were also there. They were there for one purpose. To build out and manage a coordinated wealth strategy for this one single client. “This is brilliant,” I thought. But as I watched the meeting progress, it actually angered me at the same time.

And it led me to one of two big “aha” moments in my life. This is the one event that change the trajectory of my financial career forever. Because in that moment I decided this was the kind of financial service every small business owner needs. Not just those worth $50 million dollars.

My Goal: Provide access to financial services like the ultra-wealthy use, tailored for small business owners

I spent the next 10 years of my life after that assembling a financial team to duplicate what I saw in that room. Then I spent the next 7 years testing and perfecting the system. The results for myself, my business partners and my clients has been phenomenal. My tax bill was slashed. My net worth soared. I expanded my business. And what surprised me most is that the results aren’t just financial gains. Because I found this “hidden” side benefit:

An integrated financial team improves every aspect of life

For me personally, that includes less stress, more free time, a better relationship with my spouse and family, and just an overall sense of confidence about my future. A lot of people who have witnessed this transformation in my life have asked me to personally help them with their finances. I’ve even had individuals offer me $100,000 for personal coaching. Up until last year, I could only help a few people. Now for the first time ever, I’m peeling back the curtain and sharing the details of how I built this financial superteam. That way, you can learn from my success and avoid the many pitfalls I encountered. And for the right individual, I’ll even show how you can access my own financial superteam if you don’t want to go through all the hassle. Because here’s another a critical element that took me years to figure out: It’s not just having a team. It’s having a team that’s aligned to your values and shares your philosophy of money and growth. The good news for you is that I’ve distilled everything down to a 2-page checklist that you can use to assess your current wealth architecture and financial team. I call it a Financial Strength Checklist because it shows you how ready you are for any coming financial challenge or windfall.

Download The “Financial Strength Checklist” Here

Once you fill it out, you’ll know what parts of your financial plan are covered, and where you could use some extra help. After that, you’ll also get a 5 day mini-course delivered by email on “How To Build Your Own Financial Superteam.” In the mini-course I share the story of how I built my own financial super team from scratch so you can copy my success. I share my own struggles to ease your path in building your own solid wealth team. To be honest, it was much harder than I thought, but I’ll steer you around all the land mines I encountered. And, if you want, you can even tap into my own financial superteam if building your own seems like too much work. You get all the details when you request the Financial Strength Checklist and sign up for the mini-course.

Here’s Everything You Get With the Free 5-Day Mini-Course

- A listing of the different team members you need to properly preserve, protect and grow your wealth.

- The exact process you can use to find and assemble your own team and to determine, “are they the right fit?”

- Questions to ask your existing financial team to see if they can stay or if they need replacing. (I even give you ideas on how to “break up” with advisers who don’t make the cut.)

- Tax strategies I got from my team that have saved me tens of thousands of dollars every year.

- The 4 I’s the ultra-wealthy concentrate on to make sure they don’t lose money. The first two are Income taxes and Invest losses which most people know about. The second two “I’s” are things most financial planners never help you with (because they don’t earn a commission). Getting these two pieces right will help you keep more money that’s rightfully yours and build your wealth faster.

- Special Bonus Download – Financial Strength Self-Assessment. This 2-page checklist gives you a baseline for your financial foundation, security and growth. Then it identifies each individual you would need to fill any gaps. This allows you to build a proper wealth team for your unique situation.

Get The Mini-Course + Checklist Here

Note: Why are we giving away this mini-course and the Financial Strength Checklist free of charge? First of all, it’s a way to introduce our services to business owners who want to simplify their personal finances and turn their active income into lifelong wealth within a safe and sustainable framework. We know that providing a valuable service like this will also inspire a few qualified individuals to want to work with our own Personal Finance Superteam.

But since we can only work with 125 people per year in our high-level personalized services, this mini-course and checklist is a way for us to help business owners who aren’t quite ready for the full-service program.

We also know that when we help small business owners achieve their personal and professional financial goals at the foundational level, many of them will want to work with us at a more advanced level in the future.

The mini-course gives you case-study examples of real-life financial strategies I’ve learned and implemented from my own financial superteam. I’ll even give you the exact tax strategies that have saved me and my business tens of thousands of dollars every year — and in some cases, hundreds of thousands of dollars. It’s all possible because I have an integrated financial team, and saving on taxes is just one small part of the benefits you get from having a personal finance superteam. The best way to get started building your own wealth team is to download the checklist now and follow the the mini-course emails over the next few days.

It’s a painless way to identify where you’re set in your own financial plan, where the holes are, and whether you have the right people on your team.