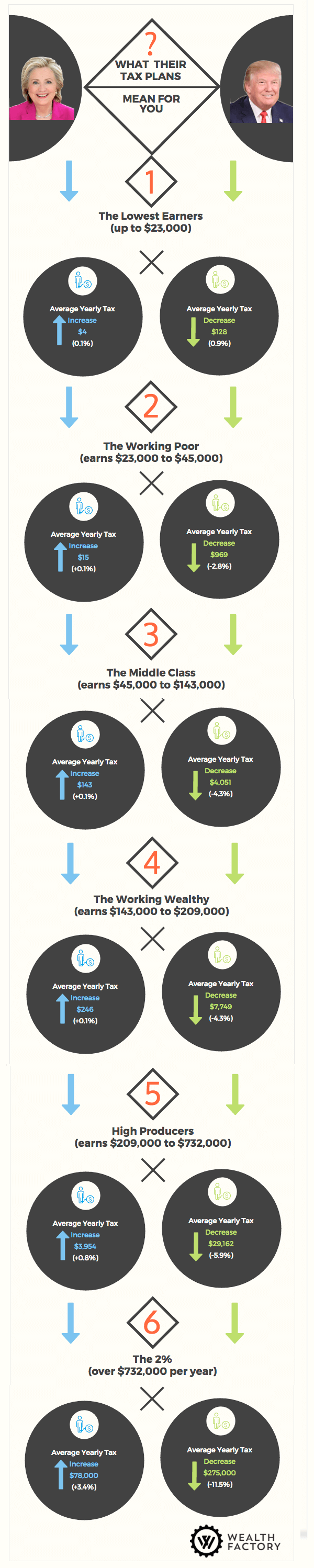

How will your taxes change under a Clinton or Trump presidency? We created the infographic below to give you a quick idea.

The data comes from the non-partisan Tax Policy Center in Washington. They provide a detailed analysis of each candidate’s proposed Tax Plan. You can see the analysis of Clinton’s full tax proposal here and Trump’s full tax proposal here.

To give you a snapshot of how your taxes might change, we’ve simplified the numbers for both plans and put them side by side. We used average salaries in each “bracket” to show the effect on American taxpayers at range of income levels.

Wealth Factory does not endorse either candidate. We provide this information as a service to show what each candidate has made publicly available.

Our belief is that taxes will likely go up in the future, no matter who is elected.

Either way, we help our clients strengthen their finances to survive (and thrive) in any economic scenario.