How Much Can You Pay Your Child Tax-Free? The new tax law has increased the amount from $6,300 to $13,850 (for 2023).

So you may want to hire your child(ren) to work in your business. And you want to do it for many good reasons: to teach them about entrepreneurship, develop a strong work ethic AND for the tax-free income — up to $13,850 per child.

Fantastic. Adding your kids to your payroll can be a great strategy, and we tell you all about it in our free guide: “32 Jobs Your Child Can Perform in Your Business to Give Your Family Tax-Free Income.”

But then, let’s say after reading the guide, you find out that this strategy “doesn’t work” if your business is a corporation.

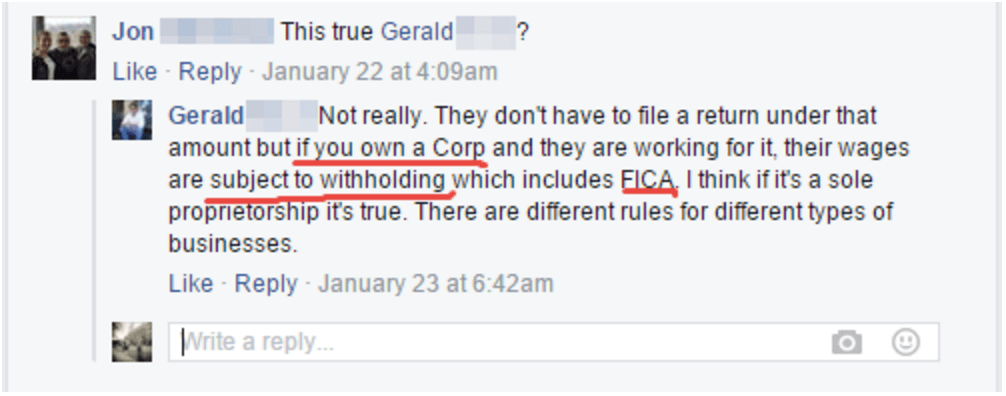

This recently happened on our Facebook page. A reader asked his advisor if our tax strategy was true or not, and this is how they replied:

Gerald says if you own a corporation, you still owe payroll taxes like FICA

Does Gerald have a point? Yes, he does. But he doesn’t have the answer, and we do.

The Corporation “Problem,” and Its Simple Solution

Gerald is absolutely right that there are different rules for different types of businesses. And that when the owners of a corporation hire their child, there are still payroll taxes like FICA to deal with.

We even pointed this out in your free guide. See for yourself:

FICA tax may not have to be withheld on work performed by a child under the age of 18 while employed by a parent in an unincorporated business (sole-proprietorship, single member LLC or a partnership where the only partners are the child’s parents). However, there is no FICA or FUTA exemption for employing a child in an incorporated business (S or C Corp) or in a partnership that includes non-parent partners. In these cases, the children are subject to the same withholding rules that apply to all other employees.

So you DO NOT have to pay payroll taxes for employing your kids if your business is a sole-proprietorship, a single-member LLC taxed as a disregarded entity, or an LLC taxed as a partnership and owned solely by you and your spouse.

But if your business is a corporation, the IRS’s rules are clear. You must pay payroll taxes on income given to your children.

So are you stuck if your small business is set up as an S or C Corp? Or if you’re planning on switching to an S Corp like we normally recommend for maximum tax advantages?

Well, it turns out there is a workaround.

As one high-profile tax strategist says: in order to lower your tax, just change the facts.

Here’s how to do it:

The Payroll Tax Workaround for Your Children

If your business is set up as an S or a C corporation, or as a partnership with other non-parent partners, the IRS says you have to withhold payroll taxes when employing your kids.

But there is a way to get around this restriction utilizing a little creativity and a “hybrid” approach.

Instead of paying your children directly from your S Corp, you pay them out of a family management company.

You can create this simple family management company as a Sole Proprietorship separate from your S Corp, and owned by yourself or your spouse.

Its only purpose is to support the operations of your Corporation, which can include the scheduling and monitoring of jobs done by your child(ren) — and all the bookkeeping and documentation necessary to keep the jobs within IRS standards.

The family management company charges the Corporation a management fee for these services and can then pay your child — which removes them from your corporate payroll.

And since the family management company is a Sole Proprietorship owned by a parent, you or your spouse, it falls under the IRS exemption where payroll taxes don’t have to be withheld.

By following this workaround, you’ve found a way to truly pay your kids $13,850 per year tax-free using nothing but the IRS’s own rules.

Keeping It All Legitimate

Just like you don’t want to create some sham job for your kids to shield income from taxes — you don’t want to just “say” you have a family management group to pay the kids.

If the Internal Revenue Service audits you, you’ll have to show that the family management company (run by one of the parents) actually did schedule and document the children’s work.

And as always, the better records and documentation you keep of their time worked, the easier any audit will be.

Is the Work Worth It?

Does the strategy of setting up a separate family management company to pay your children add a little extra complexity to the strategy? Sure. But no more complexity than having to withhold and submit payroll tax.

And if you have multiple children, the cost savings can be significant.

Is this an aggressive tax strategy? A so-called “conservative” CPA might say yes. However, it’s also perfectly legal if you do it right. You’re just changing the facts to match what the IRS code allows.

Remember, the tax courts agree individuals have the right to strategically use the tax code to their advantage and lower their tax burden.

But the IRS isn’t going to help you find the strategies, either. That’s up to you.

The key is to have a qualified tax strategist set up the plan and show you the rules to follow. Then, as long as you document everything carefully, there is nothing to fear when using legitimate tax strategies.

The Bottom Line:

When you put your child on the payroll, you divert income from your higher tax bracket into their lower tax bracket. And if you do it right, it further reduces your taxes with a business deduction for the wages paid.

Your children can then pay for their own expenses where appropriate, save for their own college and even pay their own way on family vacations.

We’ve seen this strategy save clients thousands of dollars in taxes and build stronger families. Children develop a work ethic and learn the value of money — and it can draw a family together in ways never fathomed by small business owners.

So talk to your CPA or Tax Attorney about getting your kids to work in your business today.

Quick Note: Why Don’t We Offer CPA Recommendations?

Some people have asked us if we can recommend a qualified CPA for them to use.

At Wealthy Factory, we do not currently give out CPA recommendations. Instead we have our own team of thoroughly vetted tax specialists you can access through our advanced Fast Track program.

It takes a CPA — and all financial professionals — 9 months to get through our vetting process and join our Accredited Network of approved providers. We only want to work with people who we trust to do our own taxes. That means they have to not only be great at tax strategy, they also must match our values and financial philosophy.

As a result, our vetting process is simply too exhausting for us to go through with a large number of CPAs. Instead, we choose to work with the few who have made it through the process.

If you’d like, you can see if working with our comprehensive financial network (known as The Accredited Network) is a good fit for you. Tell us more about yourself at the link below to see if we’re a good match:

Wealth Factory Custom Services

Don’t have our free guide, yet?

For more on paying yourself from your LLC, and how to do it to minimize your taxes, learn how to instantly lower your tax burden by changing how you pay yourself (article).