It’s been 103 days since the first Coronavirus infection was reported in the United States.

And 44 days since the first state-wide stay-at-home order.

Since we’re all a little (or a lot) more isolated these days, it can feel good to know that you’re not going through this alone. That you’re not the only with financial questions or challenges right now…

And that there are solutions out there to help you both right now AND in the future…

Maybe by generating or freeing up more cash flow, or by finding financial safety, or even by setting yourself up to create and grow wealth.

So last week we sent an email out to our list and asked…

“Can we get your thoughts on how you’re getting through this current pandemic?”

We then broke it down into a few specific questions, including:

How Would You Describe Your Income Status During the Pandemic?

The most common response, albeit by a small margin, was that people are seeing less work or revenue than usual. Unfortunately, that’s not surprising.

The good news is that 33% reported no change to income, while 12% reported being busier or even generating more revenue than before.

Sadly, 14% reported being laid off or closing their business.

The next question was…

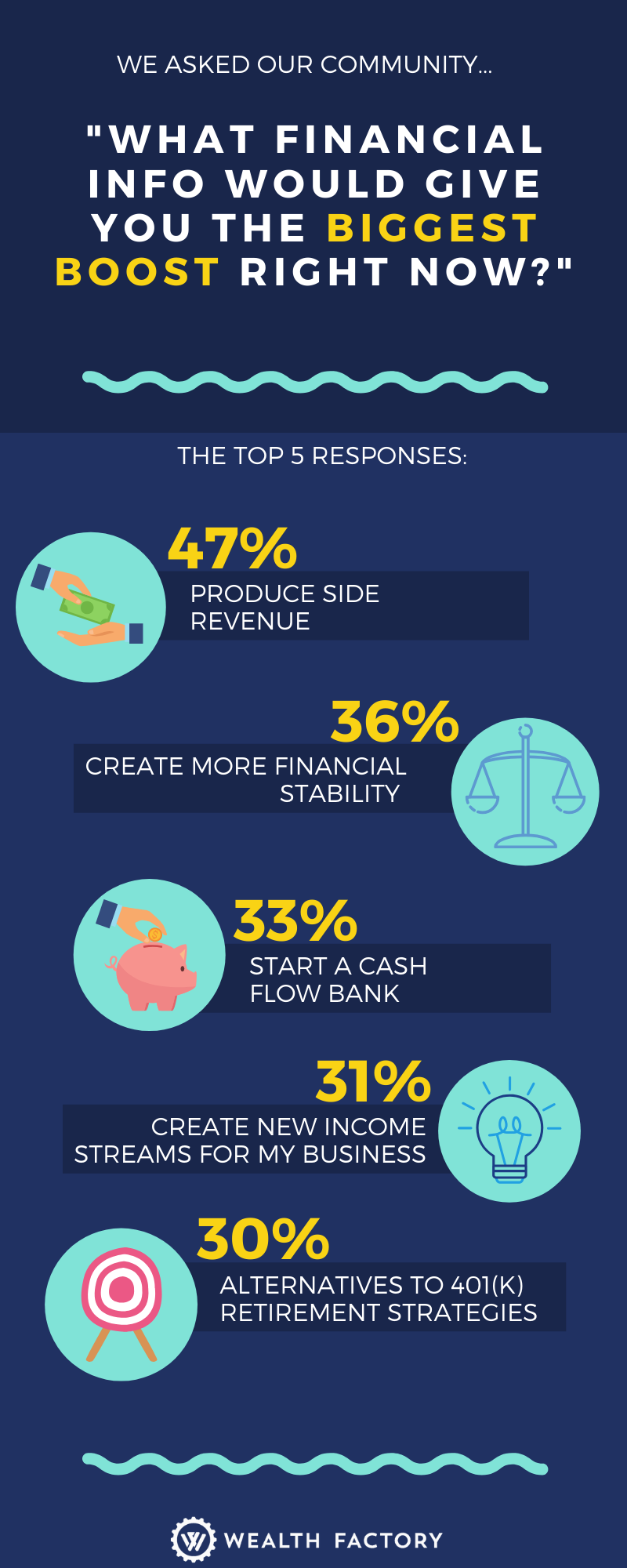

What Financial Info Would Give You the Biggest Boost Right Now?

The top response, with 47% of respondents, was information on generating side revenue.

36% were looking to create more financial stability.

And 33% — or 1 in 3 — want to start a Cash Flow Bank.

Next we asked an open-ended question:

“When it comes to the safety and stability of your personal finances, what’s the single biggest challenge that you’ve been struggling with?”

Everyone’s answer was different, but we did find a few common themes that we’ve compiled into the “top 10” current financial challenges… and then a possible solution.

Top 10 Financial Challenges, And a Possible Solution…

- How do you prepare for the loss of income from a job, business revenue or investment income… or even the loss of a line of credit?

- How do you handle business expenses AND stay afloat when your clients are spending less or going out of business themselves?

- How do you negotiate lower prices on supplies, office rent, and other business expenses to stay afloat?

- How do you invest wisely and plan for retirement with something safe that works?

- How do you prepare for the “other side of this” – your business or job is ok right now but you’re worried that things will get worse after this quarter?

- How do you generate more sales (and move online)?

- How do you continue moving towards economic independence with all the uncertainty?

- How do you add more income sources or start a new side business, and what are the best niches that will survive this?

- How do you know when and where to invest?

- What do you do if you have money in a 401k/IRA and have taken a hit in the stock market, and how do you withdraw it efficiently (and where should you put it)?

It Comes Down to Safety and Cash Flow

Chances are, you can relate to a few, several or even all of these 10 financial challenges.

And what they all distill down to is this…

People want a safe place to store or invest money so they don’t lose any more than they already have

And they want more income or cash flow to stop the bleeding and build back their savings, preferably without disrupting their pre-pandemic lifestyle

And to address those two big concerns, Garrett held a special webinar Tuesday, May 5, 2020 – and we have the replay available for you below.

On the webinar, Garrett introduces you to the single most important financial system he’s ever used.

It’s called Cash Flow Banking — and it’s Garrett’s never-failed-me system that’s carried him through 5 market crashes and 2 major recessions unharmed.

It’s also the backbone of Garrett’s financial success over the last 20 years.

We’ve received so many emails, texts and messages over the last couple months thanking us for helping people get their Cash Flow Banking system set up.

Because when the markets tumbled and the economy began to suffer, those with a Cash Flow Banking system remained calm knowing that they had taken control of their wealth… and it wasn’t at the mercy of others or the markets.

The webinar replay is completely free and ready to watch now — so click the link below and get comfortable:

Webinar Replay: Why Right Now May Be the Best Time Ever to Start a Cash Flow Bank

Want another reason to watch the webinar replay?

Garrett also shows you how to build an extra (or multiple) income streams to fund your Cash Flow Banking system.

And even how to come up with a new million-dollar income-stream idea in about 10 minutes.

(Plus, there are literally dozens of ways to start funding your Cash Flow Banking system without having to earn more money.)

Build the life you love.

The Builders at Wealth Factory