Overpaying taxes is one of the biggest cash-flow bottlenecks of small business owners and professionals.

You can get significant tax savings with proper planning. In fact, a meeting with your CPA, Tax Attorney or Estate planning team before the end of the year could easily pay for your next family vacation (and then some).

Here’s the key. You don’t want to spend more money on things you don’t need just to save a few dollars on your tax bill. That’s not smart tax planning.

Instead, this is about strategically accelerating or delaying specific purchases you’re already planning to make. Or seeing if a new tax strategy puts money back in your wallet.

Everyone’s situation is unique, so it’s important to schedule a meeting with your tax professional before the end of the year to discuss these tips. Here are a few ideas to take into your meeting:

Year-End Tax Tip #1 – Defer Income & Accelerate Expenses

A time-honored tax strategy for small business owners is to get in as many deductions before the end of the year.

Since tax rates are presumably going down next year under the new administration’s tax proposals, this strategy is all the more important.

But instead of just buying things willy-nilly to get a deduction, you want to be smart about it. One way is to move some normal expenses due next year into this year, and shift some income from this year into next year.

Cash method accounting allows you to micro-manage your year-end business taxable income in order to minimize taxes over the two-year period. Since most small businesses use the cash method, that’s what we use in the following examples.

Important note: These techniques may not work if you use the accrual method. Always talk to your qualified tax professional before taking action.

To defer income until next year, the general rule is that you don’t have to report income until the year you receive cash or checks in hand or through the mail (for cash-based businesses). To take advantage of this rule, you can wait until near the end of the year to send out some invoices. That will defer some income until the next tax year because you won’t collect the money until early next calendar year. Only use this for customers with solid payment histories.

To accelerate expenses, there are several techniques you can use. Take a look ahead to bills that aren’t due until January. Consider paying them with checks and mail them a few days before year’s end. The tax rules say you can deduct these expenses in the year you mail the check. That reduces your taxable income this year and makes next year’s higher (when you will presumably be taxed less). If the expense is significant, you may want to send the payment via registered or certified mail, so you can prove they were mailed this year.

If you have recurring expenses that will come due in early-mid January, consider charging them on your business credit card right before the end of the year. You can claim these recurring expenses as current year deductions even though the credit card bills won’t actually be paid until next year.

Pre-paying for expenses is also a great way to accelerate your deductions. Before you get too carried away, though, understand the rules. In general, the tax code says that if your prepayment creates an asset, you can’t deduct it until you get the benefit.

However, for cash basis businesses there is an exception known as the “12-month rule.”

Basically, it means you can prepay for items up to 12 months in advance and take the deduction now. It’s a little more complicated than that, but the details are in Regulation Section 1.263(a)-4(f) if you want to talk to your tax advisor about it. It’s definitely worth it.

Year-End Tax Tip #2 – Accelerate Depreciation

Section 179 rules are a huge boon for small business owners. It allows you to take an instant depreciation deduction for eligible new and used assets instead of depreciating them over time.

The amount has traditionally been limited to $25k but was permanently increased to $500,000 with the passage of the PATH act of 2015 (PATH stands for Protecting Americans from Tax Hikes).

So as long as you purchase a qualifying non-real property for business use before the end of the year, you can get a huge tax write-off on this year’s taxes.

You may even be able to take the full Section 179 write-off with a qualified, non-tax capital lease.

There are lots of rules to follow, including some limitations and exceptions, so be sure to talk through your options with a tax professional. It’s totally worth the effort if you are considering the purchase of any kind of business equipment or software in the next year.

For more information, see Section 179 explained.

Year-End Tax Tip #3 – Get A Second Opinion On Your Taxes

Having a second set of eyes take a look at your tax situation can often uncover tax deductions your regular CPA or tax preparer missed.

Not only can this help you for this year’s taxes — you can potentially get a huge “bonus refund” on top of it.

Here’s how it works. Have the new tax professional check taxes from the previous three years. If they find new deductions or credits your previous tax returns missed, you can file amendments and get a refund.

The IRS allows you to go back 3 years from the date you file the original tax return. So if you haven’t had a second opinion on your taxes in the last 3 years, now is the time to act.

Technically, you have until April 15 to file an amendment. For example, you can amend your 2013 taxes all the way up until April 15, 2017 (assuming you filed them on or before April 15, 2014).

However, the next few months are “busy season” for most tax professionals, so you want to start now to give yourself time to get scheduled and give them the time they need to review your past taxes.

Remember most tax preparers simply act on the information you bring them. Try to find a tax professional who will ask questions and probe for information. A great, proactive tax pro will often uncover tax-saving strategies most CPAs miss.

Even if you already have a great CPA, sometimes a new set of eyes helps.

Even a Member of Our Team Benefitted from This Tax Strategy…

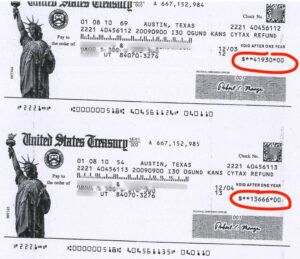

One of our very own Wealth Factory money nerds got a second opinion from a tax attorney a few years ago and the result was two separate refund checks totaling over $50K.

Without that second opinion, this money would have been lost forever.

Even if the amount you recover is only a couple thousand dollars, it’s always nice to get a little “bonus refund” you weren’t expecting.

Many of our members have benefitted from this strategy…

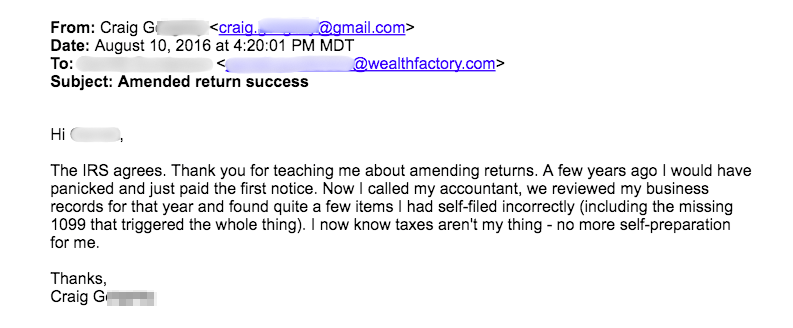

For example, Wealth Factory member Craig G. learned about this tax-saving technique in BUILD:, our weekly personal finance publication for entrepreneurs.

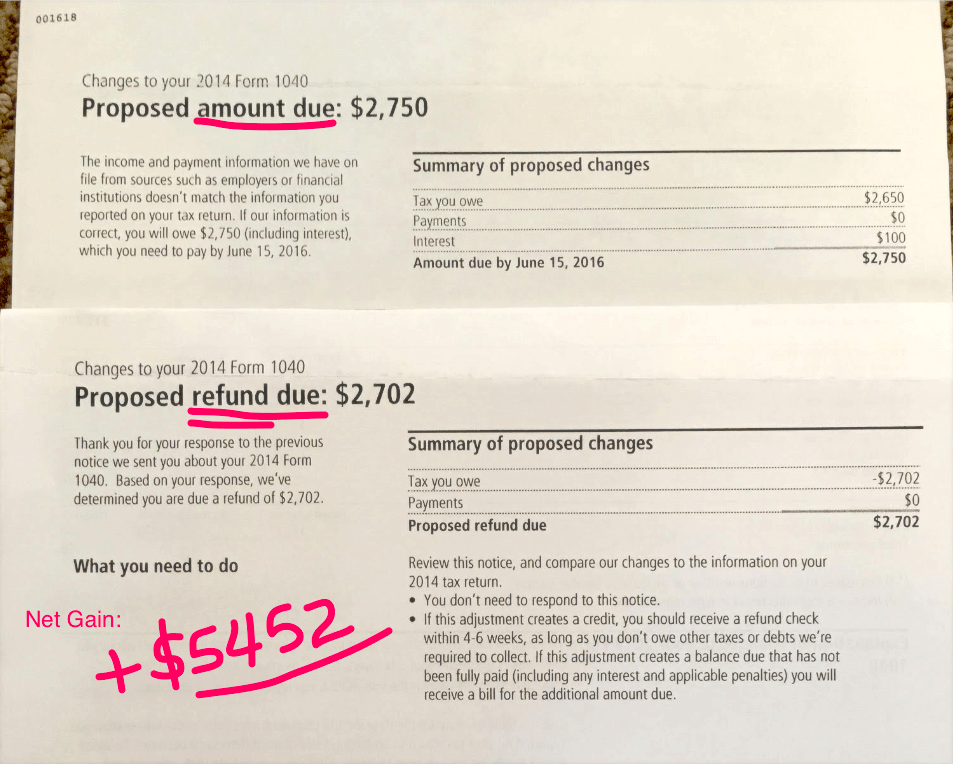

He didn’t act on it until he got a notice from the IRS saying he owed $2,750 from an error on his tax return 2 years earlier.

After he got a second opinion and filed an amendment, he got a second notice from the IRS saying he was now owed a $2,702 refund. That’s a net gain of $5,452.

Essentially, the $397 price Craig spent on the BUILD: publication netted him 12X return on investment. Not bad, huh?

Here’s the actual email he sent:

BONUS Tax-Saving Tip:

Educational material, including online courses, can reduce this year’s taxes (likely taxed at a higher rate). Just make sure you purchase the training course before the end of the year, even if you don’t plan to use the course until next year.

You can also combine the 12-month prepaid expense rule (explained above in Tip #1) with monthly subscription plans on software services or monthly coaching tuition.

For example, let’s say you pay for 12 months of business or financial coaching that doesn’t begin until January of next year. You benefit next year as you grow your wealth month by month. But you get the full tax write-off on this year’s taxes, as long as you prepay in advance.

There are endless ways to save tax when you know the rules and combine strategies like this.

Your End of Year Tax-Saving Action Plan:

- Meet with your tax team before the end of the year. Be proactive with strategies you bring them. Consider the strategies above as well as those in your BUILD: subscription, Curriculum for Wealth, or Accredited Network Files. Our team also offers some excellent free tax tips in the Cash Flow Recovery Guide.

- Consider getting a second opinion on your taxes from the last three years to see if you can amend any old returns and get back cash that’s rightfully yours.

- List any purchases you plan to make next year and consider making them before the end of the year to reduce this year’s taxes.

That’s all for now.

Build the life you love,

The Builders at Wealth Factory