One of the most under-utilized provisions in the IRS tax code is the rule that allows you to go back three years and file an amendment.

Why is it so under-utilized? Is this how to get a tax refund?

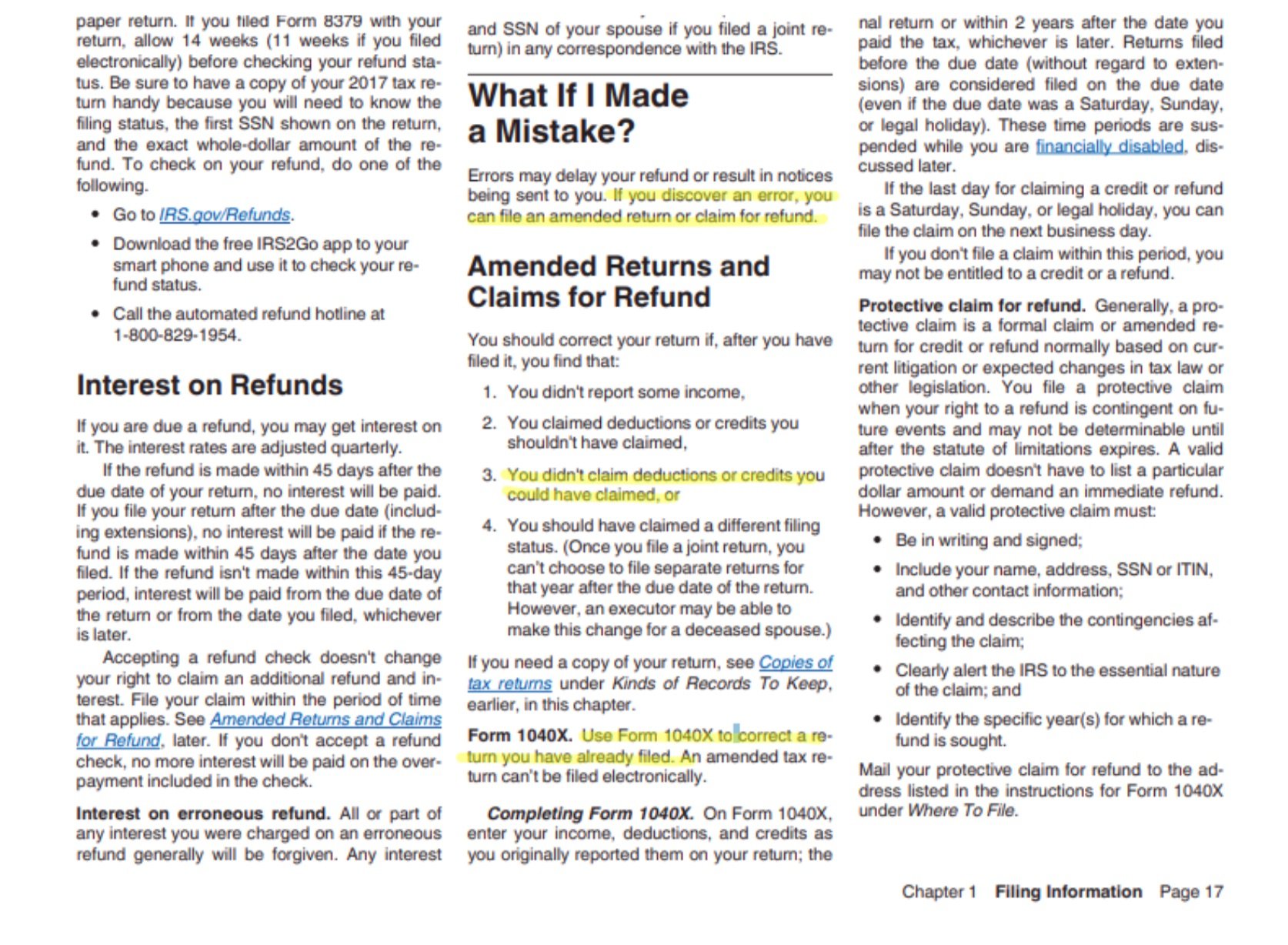

Most people think tax amendments are only applicable if you OWE more money. Probably because that’s how the IRS promotes it in their literature.

They say things like “if you underreported your income, or forgot to include an income stream, or if you took a deduction you shouldn’t have — you need to file an amendment and pay those taxes.”

(See the yellow highlighted parts in the image below)

But the same tax code allows you to amend a tax return to apply a tax-saving strategy you didn’t know about 2 or three years ago.

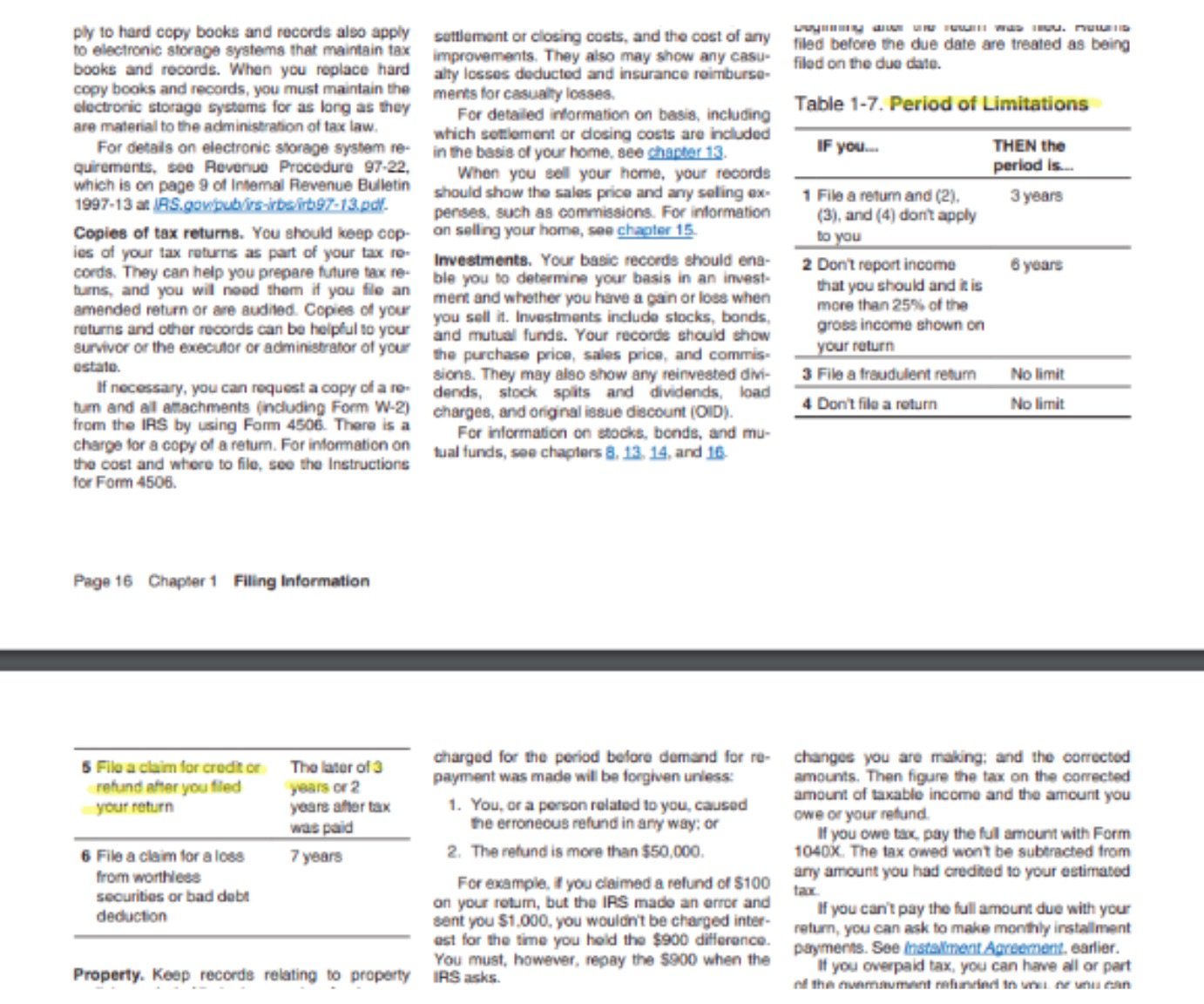

This is the section that tells that you have up to 3 years to file an amendment:

Some tax strategies can’t be done retroactively — which is why creating a great proactive tax strategy is so important.

But many tax strategies can be applied retroactively.

So if you learn about a new tax strategy that you say “darn, I wish I had done that” — it may not be too late.

A good CPA can get most of your money back from the last 3 years if you’ve overpaid.

Why a Second Opinion is Critical

So the question is, who do I go to to do something like this?

The quick answer is — you want someone completely different than the person who did your taxes.

That’s because the person who did your return will likely have blind spots. And if they missed something the first time, they probably will miss it again in a review.

This applies even if you already think you have a great CPA or tax team.

Case in point: Here at Wealth Factory, our Founder and Chief Wealth Architect, Garrett Gunderson has great CPAs.

Yet they themselves encourage him to use a third party to review their work every 3 years.

Why? They understand they could have a blind spot too. Or possibly could have missed something that another preparer might catch.

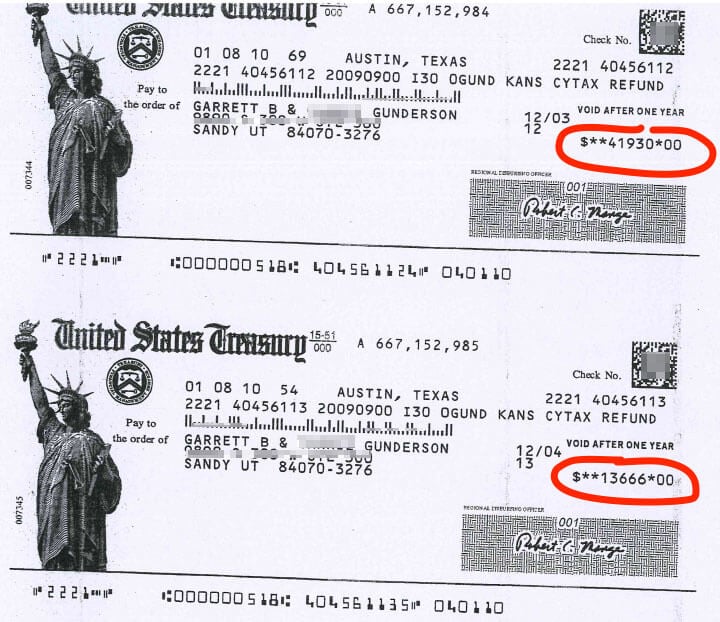

So Garrett has used this strategy multiple times — and twice he’s received “retroactive refunds” for $41,930 and $13,666.

Now to be fair, these checks were the result of a 3-year tax review Garrett had done by a Tax attorney.

Tax attorneys can be a lot more expensive than CPAs. But depending on the complexity of your return and how much you’ve overpaid in tax, the expense can be worth it.

In Garrett’s case, it was more than a 6:1 return.

Of course, Wealth Factory clients have also benefited greatly from this strategy. So let’s take a look.

Client Case Studies

To be totally transparent — the examples we cite below are from clients we work with 1-on-1 in our elite FastTrack program.

These are business owners who are bringing in a minimum of $500k in top-line revenue and at least $250k in personal income.

Plus, they’ve had to apply to the program and attend one of our 3-day workshops in-person.

That means these examples may not be typical of all business owners.

Still — at that level, nearly every client has received some kind of retroactive refund using the 3-year review. The lowest refund was $800. The highest was over $400,000.

And even if you don’t find any kind of retroactive refund, a 3-year review would still give you the peace of mind knowing that you have not been overpaying on your taxes.

That said, let’s take a look at what’s possible.

* * *

$200,000 retroactive refund from IRS

Jason W., a chiropractor from Boise, ID was able to double his personal income and reach economic independence within 4 years after starting to work with Wealth Factory and applying the Wealth Architecture strategies.

A big part of that was the initial $200,000 in retroactive tax savings he got with our team and his own CPA firm (who used the strategies we shared with him to file the tax amendments).

* * *

“Expecting a VERY large refund check

by going back 3 years and amending”

Patrick G., an entrepreneur from Park City says that he’d be two million dollars wealthier if he had started working with Garrett and Wealth Factory 10 years earlier.

He’s already found tremendous cash flow optimizations and tax savings using Wealth Factory strategies, and recently said, “There are tax credits that I didn’t know about, that my standard CPA never brought up. Garrett brought one to my attention, I showed it to my firm, and literally, I’m now expecting a VERY large refund check by going back 3 years and amending, which I’m pretty excited about.”

* * *

$102,000 IRS Refund + $20K yearly savings going forward

Mike G. is a businessman who was sure Wealth Factory couldn’t find him any tax savings. After all, he had hired one of the top 4 accounting firms to do his taxes. The problem was, his corporate structure was set up poorly, and this prevented him from taking advantage of 2 significant tax strategies.

Our Wealth Factory Accredited Network experts set him up with a new corporate structure, used cost segregation on his building, and restructured the way he paid himself.

After filing an amendment with these new strategies in place, the IRS sent Mike a retroactive tax refund check for $102,000. And by differentiating his income, he got an additional $20,000 in tax savings every single year going forward.

* * *

$11,000 refund, + $3,900 a month extra cash flow

David J. is one of the best marketers in his industry, and always says that he’s no slouch when it comes to taxes, either. So he was skeptical when Garrett suggested he get a 3-year tax review. But after the review, he was able to file an amendment that gave him an immediate $11,000 retroactive refund, and then $3,900 a month in cash flow going forward. That’s an extra $46k in cash flow each year. Needless to say, our strategies surprised him!

When’s the best time to get a 3-year tax review?

The IRS has limited the time you can go back and amend a return to 3 years.

That’s why we recommend our top clients get one of these reviews done once every three years — to catch anything that might have been missed.

You can file an amendment any time during the year. Just realize that you get three years from when you filed going back three years. So if you file on April 15th, that’s your cutoff date. If you get an extension, your cutoff date could be well into the Fall.

Another thing to consider is how busy the CPA or Tax Attorney is who does your review. CPAs generally will have the most time in the Summer months. But October-December can also be a good time.

Most CPA and tax firms are off-the-charts busy during tax season. And while that doesn’t mean you can’t get a review done during that time — just realize it will likely take longer.

One last item to consider. We suggest choosing someone who has a higher level of expertise or experience than your tax preparer.

While that’s not absolutely necessary, it does increase the likelihood of them being able to find any hidden refunds in your last 3 years of tax returns.

Next Steps:

- Search out a reputable CPA or Tax professional who will offer this service. Some may offer the service for free — but don’t be afraid to spend some money on this. Even if you don’t reclaim anything significant, the peace of mind knowing you aren’t throwing away money unnecessarily can be worth it.

- We offer this service as part of our Tax-Cut package (which we offer in March, April, and September). However, there will be a unique opportunity to get a 3-year tax review as part of the one-day Black Friday Special held next week. Watch for an email from Garrett on Monday (and sign up for early bird access if you’re serious about getting the best deal)

That’s it for now.

Build the life you love,

The Builders at Wealth Factory