The warning signs are all in place:

A bear market is coming.

All the experts agree. The only question is when it will happen.

Some say as soon as next month. Others say the current bull market may push into 2020 before the tide turns.

That kind of uncertainty sucks the life out of most wealth plans…

Because that’s how people get blindsided with bad economic news they didn’t see coming — and then helplessly watch their years of hard work and investing swirl down the drain.

The most obvious danger is if you have money invested in the stock market.

But the risks bleed out into other areas of your life too, because bear markets tend to drag down the entire economy.

Fortunately, there is an elegant solution to all this.

But first…

What’s Going On Here?

Market experts are beginning to see the warning signs of a bear market coming as early as this Fall.

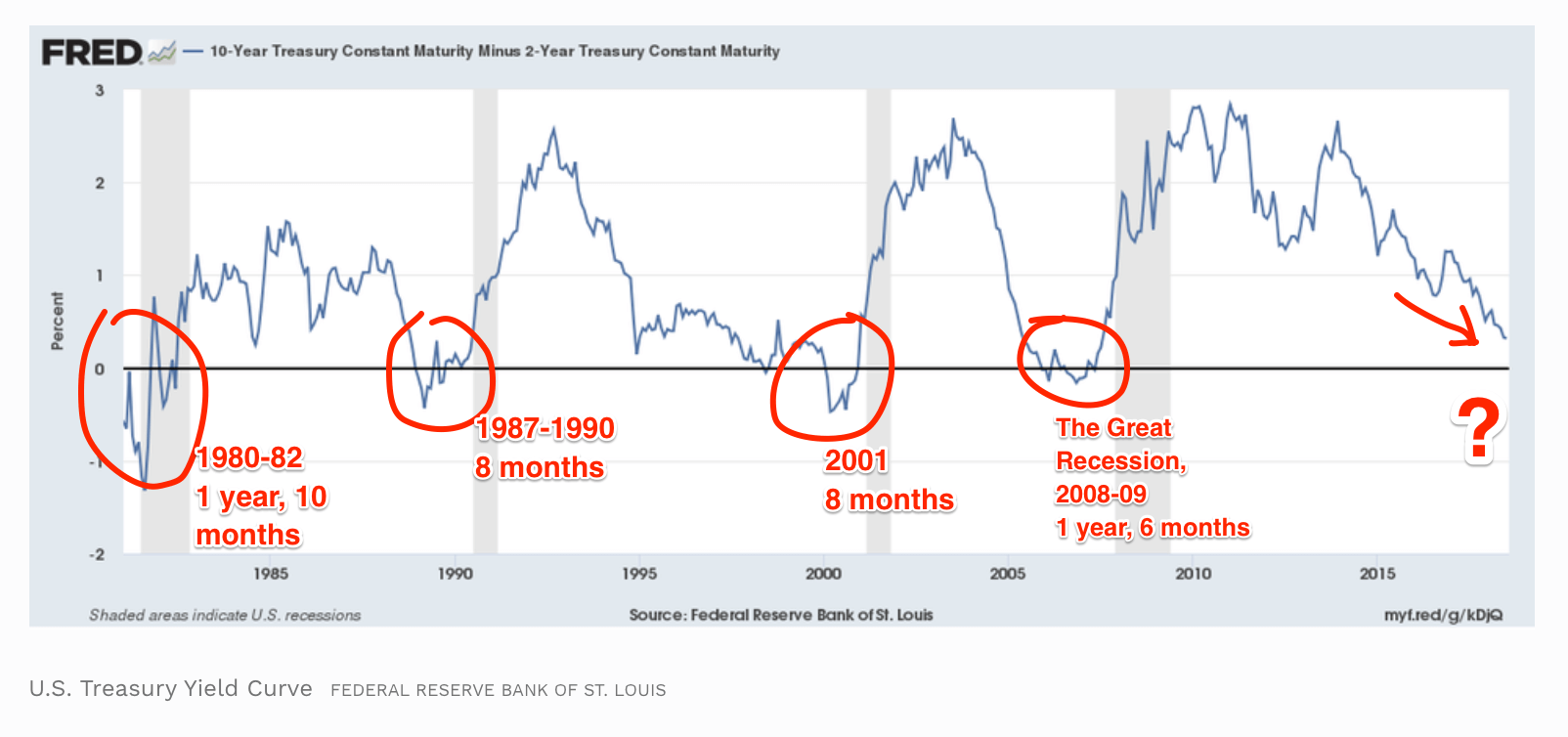

For example, the Treasury Yield Curve has long been an indicator of economic recession and bear markets.

This is the difference between 10-Year Treasury bond yields and 2-year bond yields. Whenever this ratio goes negative, the US economy has suffered the consequence.

Just take a look:

As you can see, every time the US Treasury Yield Curve has gone into the negative in the past 40 years, we’ve had market turmoil and economic recession.

Some pundits claim that “it’s different this time.”

But they said it was “different” in 2007 too. And 1999. And 1990.

You get the point.

But Wait, There’s More…

If it were just the yield curve that was signaling a bear market, it would be easier to refute. Especially since the ratio hasn’t yet gone negative.

But economists are always looking at a basket of indicators to make their predictions.

Here are just a handful of bear-market indicators:

- Extreme optimism just before the sell-off. We may not be there yet — but earlier this week, many of the largest companies were scoring 52-week highs, like Microsoft and Facebook. And according to this WSJ story, hordes of new individual investors have been diving into the stock market this year, finally shaking off their fear from 2008. It may not be “irrational exuberance” yet — but it’s trending in that direction

- Higher borrowing costs. As we pointed out earlier this year, the Federal Reserve is planning to continue hiking interest rates which will have ripple effects throughout the economy.

- Weakness in leading stocks. It’s too early to tell for sure, but Facebook’s recent 19% drop in one day — which purged $120 billion off its market value — certainly isn’t a good sign.

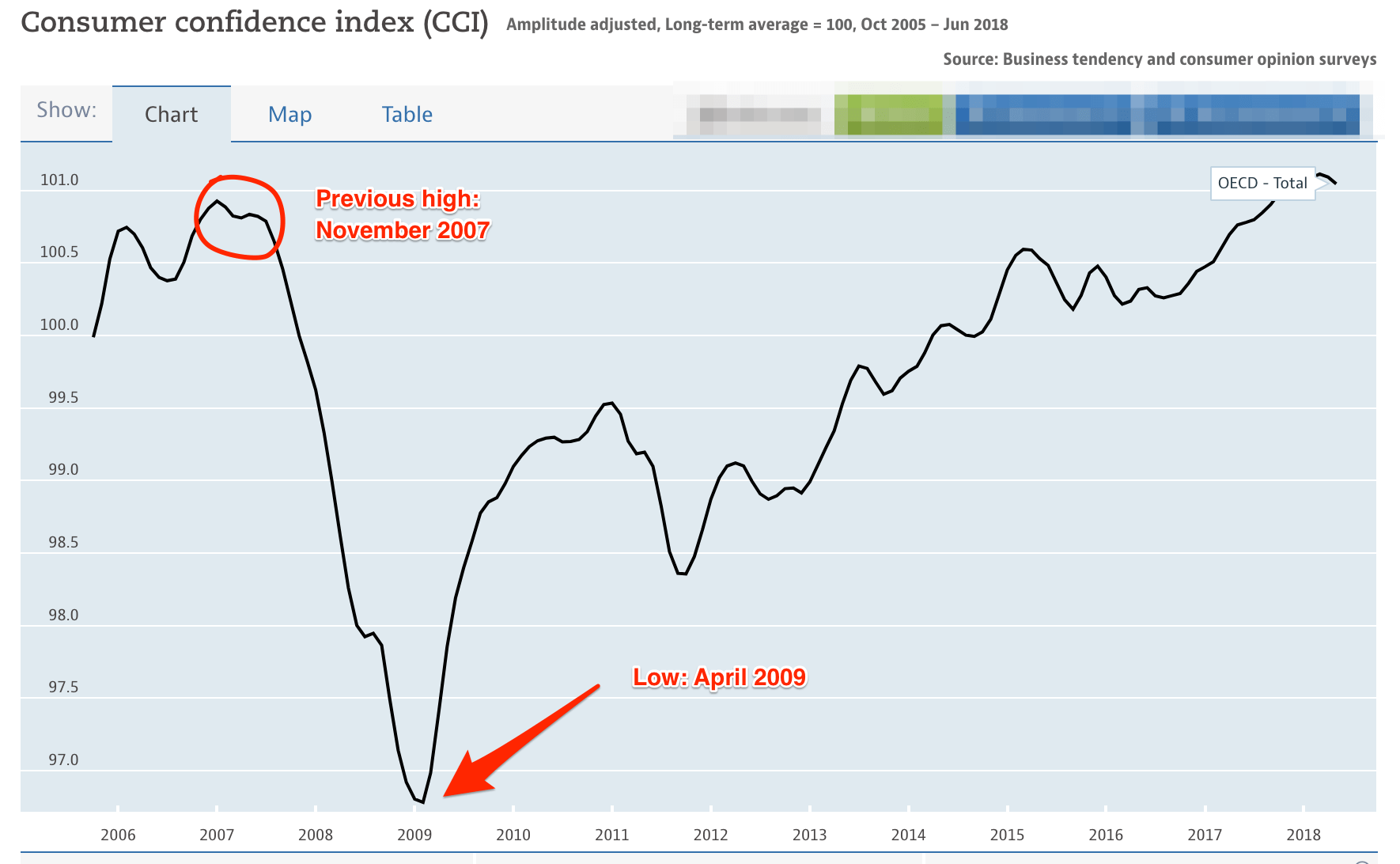

- Falling consumer confidence. This is generally one of the last dominoes to drop leading up to a bear market, partly because people are too stubborn to think any economic party could possibly end, and partly because they don’t have the data or the skill to analyze what’s going on behind the scenes. In other words — consumers are usually “the last ones to see it coming.”

Here’s a case in point: the Great Recession of 2007-2009 officially started (economically speaking) toward the end of 2007. The data was all there, but as you can see, consumer confidence was actually at historic highs:

It wasn’t until the recession was over that the Consumer Confidence Index (CCI) hit its low point.

The CCI has been on the rise since late 2011 and has recently surpassed the 2007 highs.

While that doesn’t necessarily prove anything on its own, it’s uncanny how history tends to repeat itself, over and over again.

And viewed with the other indicators, it seems likely that the next Bear Market is just around the corner.

Our Big Prediction (drumroll please)…

So what’s our take on all this here at Wealth Factory?

Here’s the thing. You don’t need financial expertise to predict any of this.

Markets are cyclical. And they ALWAYS fluctuate.

And just like gravity, whatever goes up must eventually come down again.

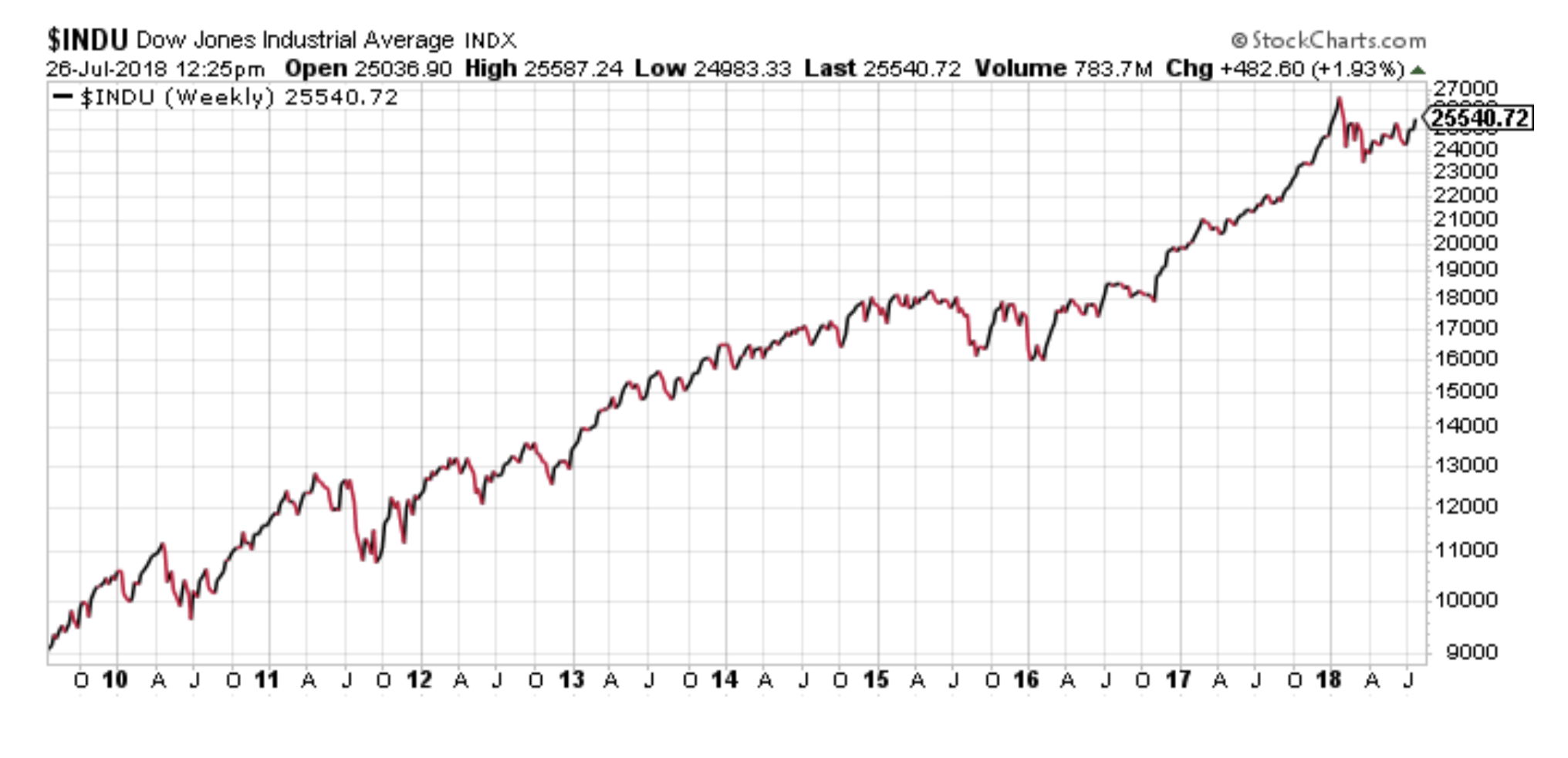

So all you have to do is take a look at the stock market over the last 9 years:

The Dow Jones Industrial index has steadily climbed with little more than minor corrections for nearly a decade.

Everyone knows it can’t stay on that trajectory forever.

So the fact is, there will be another market downturn at some time.

Whether it’s a minor correction or “the big one” remains to be seen.

And exactly when it happens is anyone’s guess.

Why None of This Needs to Matter (to you)

This is one reason why we approach investing so differently than anyone else in our industry.

We don’t invest our client’s money or take assets under management.

Instead, we teach them to become a better investor.

Because we’ve learned the hard way that risk is in the investor, not the investment.

To become a better investor, it is imperative for you to eliminate any aspect of uncertainty or gambling that can put your wealth at risk.

We accomplish this with 2 key strategies: Strengthsvesting and Investor DNA.

- Strengthsvesting at its core is about you. What type of investor are you? What are your strengths? What are your proficiencies?

- Investor DNA is the key to know what to invest in.

Knowing your Investor DNA not only allows you to know what to invest in — it also saves time, frustration, and money by knowing what not to invest in.

In the massive universe of investing, there are dozens upon dozens of investments out there beyond stocks, bonds, and real estate.

If any of these investments are outside of your expertise, there is risk.

You are not built to be an expert in everything.

So if you limit your investments to just a few that match your Investor DNA perfectly — and FOCUS on managing those few investments well — that is the key to strategically engineering your wealth.

In short, when you utilize Strenghtsvesting, you’ll be a better investor.

And once you’re in a strong financial position like that, nothing that happens in the stock market or the economy matters.

Your next steps:

- First, take the Financial Strength Grader Quiz. It has 4 sections that measure your financial strength in the areas of Cash Flow, Protection, Debt, and investing. At the end you’ll get an overall “score” on how strong your finances currently are.

- After you get your score — the Financial Strength Grader page has a series of free lessons, videos, guides, calculators, and tools to help you strengthen your finances. It even gives you a workbook to chart your progress to Economic Independence.

- In the Investing section of the Financial Strength Grader page, be sure to download The Investment Guide for Entrepreneurs. This will help you establish an investment philosophy that utilizes Strengthsvesting instead of “gambling.”

- Next, download The Investment Scorecard. Run every investment you have through this tool. You’ll get an objective “score” to show you whether the investment fits within your Investor DNA so you can maximize every investment you make — and eliminate any investments that will likely fail you.

- If you have a large portfolio and feel like you need help from an integrated financial team including a Registered Investment Advisor (who by law must look out for your benefit in all investment decisions and doesn’t make any commission off of your investments)… apply here to see if working with our Wealth Team 1-on-1 is a good fit.

Build the life you love,

The Builders at Wealth Factory

What is Living Wealthy?

Living Wealthy is a digital publication of Wealth Factory where we share timely trends, news stories, and current events that affect your life. We help you see the impact, personally and socially, and give you possible solutions to avoid any negative effects. We also give you additional links and resources if you want to investigate further. The purpose is not to be the last word on any topic. Rather it’s to help us all stay informed of what’s going on in the world without letting those events negatively impact your lifestyle. Our goal is to help us all live richer, fuller lives from a position of financial strength. This allows you to weather economic hard times, and seize whatever new opportunities arise in our changing world.