Today we take a deeper look into the Cash Flow Index and see how it can help you blast through your loan repayments in the most efficient cash flow manner.

Note: This is part 2 of a 3-part series. In the last issue, we showed you 5 Steps to Safely and Quickly “Cash Flow” Your Way Out of Debt.

The Story

The average American household has $16,061 in credit card debt and $132,539 in total debt.

Perhaps even more alarming is that many people, eager to pay off their debts more quickly, adopt debt-reduction methods that add risk and negatively impact their cash flow.

The Cash Flow Index (CFI) is a scoring system to help you identify the efficiency of each of your loans. It allows you to pay off the most inefficient loans first. It then prioritizes the repayment order of all remaining loans to maximize your results.

Why Should I Care about the Cash Flow Index?

How you go about paying off your debt can have a profound effect on your financial safety, security and wealth creation potential.

We’ve discovered over the years that a cash flow focus always wins.

That’s why the Cash Flow Index works so well. It tackles your payables from a cash flow perspective first. Then it systematically eliminates debt while still allowing you to enjoy your money along the way.

So the Cash Flow Index we show you today will not only help you eliminate debt quickly and safely, it also helps you increase your cash flow and live wealthier now.

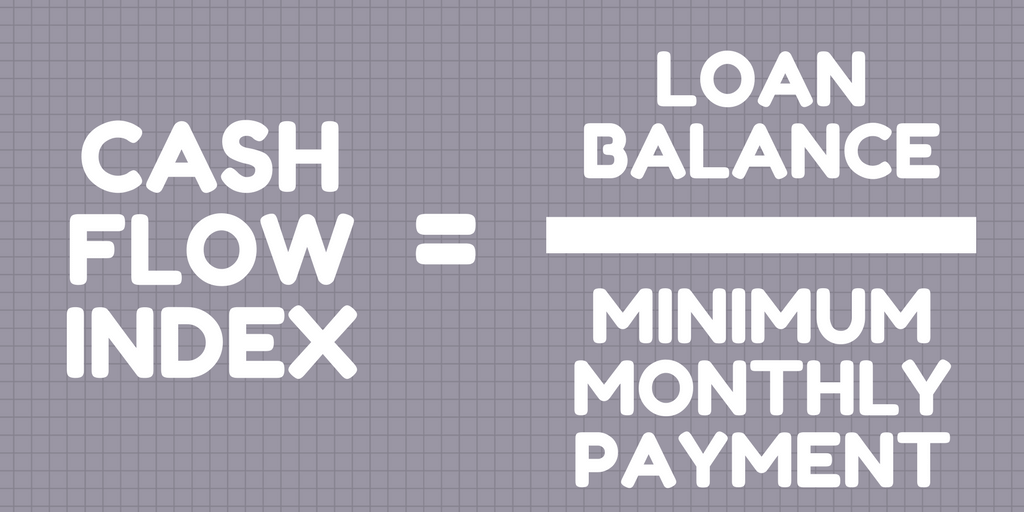

How Does the CFI Work?

To determine the Cash Flow Index of your loans, take all your various loan balances and divide each of them by their respective minimum monthly payments:

Cash Flow Index = Loan Balance / Minimum Monthly Payment

A high number (over 100) means the loan is efficient. A low number (under 50) means it is inefficient.

So whichever loan has the lowest CFI number is the one you should pay off first.

It doesn’t matter what the interest rate is on the loan. The most important thing is how efficient it is, which is what the Cash Flow Index measures.

It may seem counterintuitive at first.

But results are the only thing that matter.

Here Is An Example

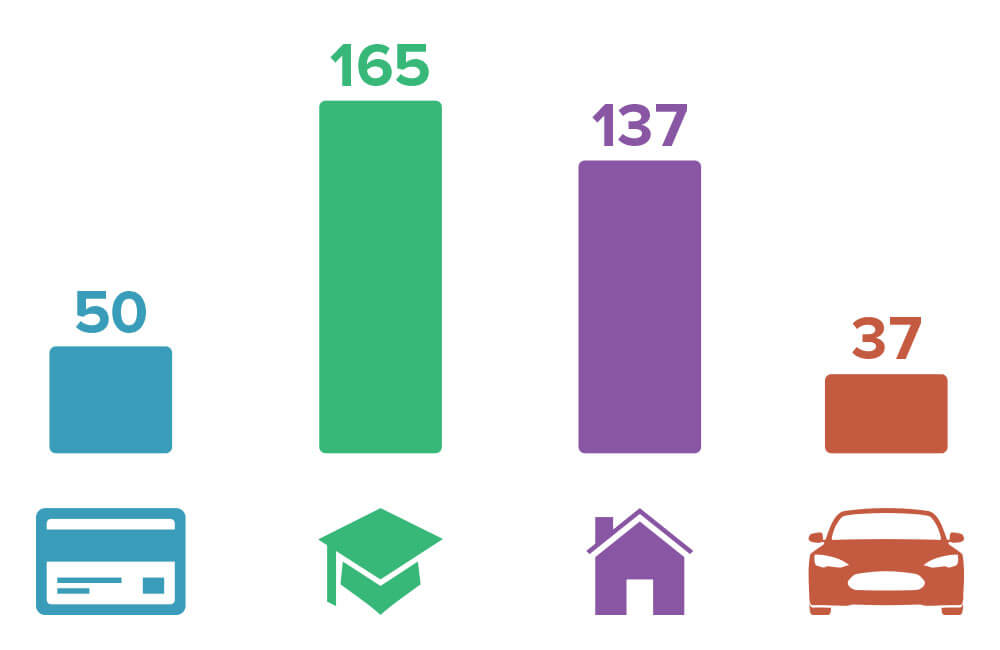

Let’s say you have the following loans:

Home Loan Balance: $228,000

Interest Rate: 7%

Monthly Payment: $1,665

Cash Flow Index: 137 ($228,000 ÷ $1,665)

Auto Loan Balance: $16,500

Interest Rate: 8%

Monthly Payment: $450

Cash Flow Index: 37 ($16,500 ÷ $450)

Credit Card Balance: $13,000

Interest Rate: 12%

Monthly Payment: $260

Cash Flow Index: 50 ($13,000 ÷ $260)

Student Loan: $107,000

Interest Rate: 3.9%

Monthly Payment: $650

Cash Flow Index: 165 ($107,000 ÷ $650)

Investment property loan balance: $50,000

Interest Rate: 5.5%

Monthly Payment: $2,000

Cash Flow Index: 25 ($50,000 ÷ $2000)

It may seem to make sense to pay off the credit card first because it has the highest interest rate.

In fact, most financial advisors and pundits will always tell you to focus on the highest interest rates first.

We’ve discovered through years of testing that ignoring the interest rate and using the Cash Flow Index gives you superior results.

By knocking off the inefficient loans first, you free up a ton of cash flow to work on other debts. This has the intended “snowball” effect of eliminating them in order, in the most efficient way.

In the case listed above, paying off the investment property loan (CFI of 25) first frees up $2000 per month.

So if you have extra cash to put towards debt retirement, put it all toward that loan first.

Next up would be retiring the auto loan (CFI of 37) which then frees up $450 per month. That amount can then be applied toward the credit card balance (the third lowest CFI).

Paying off the investment property loan and auto loan first means you can pay off both faster than if you started with the credit card, or try to pay them off equally.

What About Loans With a CFI above 50?

Once you’ve retired all your inefficient loans (those with a Cash Flow Index under 50), it’s time to look at the rest of your debt.

Any loan with a CFI between 51-100 is a good candidate for restructuring. Look at last week’s article for tips on how to do that.

For example, you may be able to renegotiate a lower interest rate, lengthen the amortization schedule, or consolidate the balance into a more efficient loan.

We help clients do this in our 1-on-1 services. In fact, we helped one business owner lower his minimum monthly loan payments from $17,000/month to $5,000 per month. Needless to say, freeing up an extra $12k per month was a huge bonus for his business.

Any loans you have with a CFI score over 100 are cash flow efficient. There’s really no need to be paying more than the minimum on them.

In fact, trying to pay down efficient loans (like making double payments on a home mortgage with a high CFI) instead of saving or investing that money could negatively impact your cash flow. More on that next week.

The best part is that once you have all your inefficient loans retired or restructured, you can start making extra investments with the freed up cash flow.

And in the next article, we’ll show you exactly how to do that with the Investment Cash Flow Index.

What To Do Next

Eliminating inefficient loans is one of the quickest and safest ways to reduce your debt and increase your monthly cash flow, and the CFI is the best tool we’ve found to make it simple.

With that in mind, here are your action steps to consider today:

- Run the Cash Flow Index formula on all of your loans.

- Choose the loan with the lowest CFI score to tackle first. Make minimum payments on all your other loans and redirect all the extra dollars to the one with the lowest CFI.

- Rank the other loans in order, from lowest score to highest. Consider restructuring loans with a score of 50-100. Loans over 100 are efficient and don’t need any special attention.

- Use the Investment Cash Flow Index (revealed in the next article in this series here), to find inefficient investments you may be able to use to pay off inefficient loans faster.

- Celebrate your debt-reduction victories along the way. Be sure to put a percentage of your newly created cash flow into a “Living Wealthy account” and treat yourself. Because the Wealth Factory way isn’t about sacrifice and delay, it is about living wealth today.

Not sure what a Living Wealthy account is? Want full access to all our cash recovery techniques?

You can inquire about our boutique 1-on-1 financial services here to see if working with our team is a good fit.

Our money nerds are constantly working hard behind the scenes to find the fastest, simplest, and safest ways to put more money in your pocket.

Until next week…

Build the life you love,

The Builders at Wealth Factory

What is Living Wealthy Weekly?

Each week we share timely trends, news stories, and current events that affect your life. We help you see the impact, personally and socially, and give you possible solutions to avoid any negative effects. We also give you additional links and resources if you want to investigate further. The purpose is not to be the last word on any topic. Rather it’s to help us all stay informed of what’s going on in the world without letting those events negatively impact your lifestyle. Our goal is to help us all live richer, fuller lives from a position of financial strength. This allows you to weather economic hard times, and seize whatever new opportunities arise in our changing world.