Meta Description: Explore strategies for entrepreneurs on building cash flow. Learn tips from leveraging investments to minimizing expenses, and boost your business’s health.

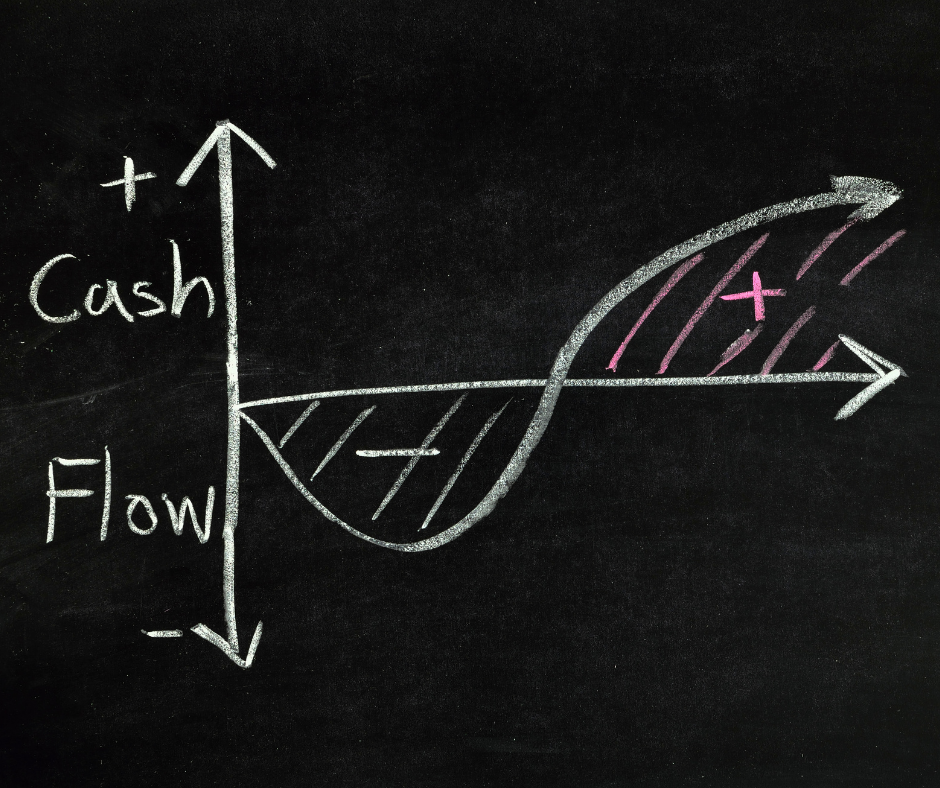

How do you build cash flow as a small business owner or entrepreneur? This question is crucial to your company’s financial health and success. Managing cash flow effectively involves strategies that increase inflows while minimizing outflows, ensuring a positive cash flow statement.

In this blog post, we’ll delve into five key strategies for building robust cash flows. Discover the advantages of using tax-favored retirement plans to augment your gross earnings.

We’ll also discuss leveraging investment opportunities to enhance your working capital and developing passive income streams that keep money moving into your bank account, building that net income, even when primary operations slow down.

Additionally, we’ll examine ways to minimize operating expenses without compromising quality or productivity. Finally, we’ll touch on taking advantage of business tax breaks that can help pay off debts faster and improve overall cash flow management.

Utilize Tax-Advantaged Retirement Accounts

Want to boost your cash flow? Consider leveraging tax-advantaged retirement accounts, such as 401(k)s, IRAs, and Roth IRAs to unlock the power of compound interest for your financial future. They’re like financial superheroes, here to save the day.

The Power of Compound Interest

With these accounts, your cash flow statements are sure to grow and grow, thanks to compound interest. It’s a perpetual profit generator that keeps on delivering.

Tax Benefits

Retirement accounts don’t just provide an opportunity for your net income to grow, they also offer tax advantages. Traditional accounts reduce your taxable income now, while Roth accounts let you enjoy tax-free withdrawals later. It’s a win-win.

Diversification Opportunities

Retirement accounts also let you diversify your investments, like a buffet of financial options. Stocks, bonds, mutual funds—you name it. Spread the risk and watch your cash flow soar.

Finding the Right Retirement Account for You

Choosing the right retirement account is like finding the perfect pair of shoes—it has to fit just right. Talk to a financial advisor who can help you make the best choice for your financial goals. They can walk you through all the ins and outs of your cash flow statements; help you calculate cash flow, discuss the best way to save more cash, and answer all your questions about your financial statements.

Leverage Investment Opportunities

As a businessperson or small enterprise proprietor, you’re not just in the trade of running your organization—you are also handling your riches. One effective way to build cash flow is by leveraging investment opportunities such as stocks, bonds, mutual funds, and real estate.

Investing in Stocks and Bonds

Stocks represent ownership shares in a corporation while bonds are essentially loans made by investors to corporations or governments. Both can provide income through dividends (for stocks) or interest loan payments (for bonds), which can be reinvested for compound growth.

To get started with investing in these assets, consider opening a brokerage account with platforms like Charles Schwab or Fidelity Investments that offer access to thousands of different stocks and bonds. Remember though: it’s important to diversify your portfolio across different sectors and asset classes to minimize risk.

Mutual Funds Investment

Mutual funds, on the other hand, pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by professional fund managers. They offer diversification benefits similar to owning individual stocks and bonds but without requiring significant capital upfront.

Dabble into Real Estate Investing

Besides traditional financial instruments like stocks and bonds, real estate investing can also serve as a powerful tool for building your statement of cash. This could involve buying rental properties that generate steady monthly income or flipping houses for profit.

The Power of Diversification in Building Cash Flow

In essence, leveraging various investment opportunities allows entrepreneurs and small business owners to increase their wealth over time and create additional streams of passive income. Diversifying investments across different types such as stocks, bonds, mutual funds, and real estate helps mitigate risks and maximize potential returns. Remember: it’s not about picking winners, but maintaining overall balance within your portfolio.

Develop Passive Income Streams

As a business proprietor or small enterprise operator, the main source of your earnings is likely to be your venture. But why not spice things up and add some passive income streams to the mix? It’s like having a side hustle that does all the work for you.

Rental Properties:

Want to be a real estate mogul without all the headaches? Invest in rental properties. Just buy a property in a hot rental market, hire a property manager to deal with tenants and maintenance, and watch the cash flow in. It’s like being a landlord without the late-night phone calls about leaky faucets.

Dividend Stocks:

Don’t want to deal with tenants at all? No problem. Invest in dividend stocks and let the companies do the work for you. You become a part-owner and get regular payouts based on their profits. It’s like getting paid to sit back and watch your money grow.

Create an Online Business:

Why limit yourself to the physical world when you can make money online? Set up an e-shop, become a partner marketer, or write a blog. The internet is your oyster, and it’s open 24/7. It’s like having a business that never sleeps.

Having multiple streams of passive income not only boosts your bank account but also provides financial security. If one source dries up, you’ve got others to fall back on. It’s like having a safety net made of money.

Minimize Expenses

If you’re an entrepreneur or small business owner, one of the best ways to boost your cash flow is by cutting costs. But don’t worry, we’re not talking about sacrificing quality or service—just being smart with your spending.

Cut Costs on Utilities

Don’t let your utility bills drain your bank account. Switch to energy-saving light bulbs, use programmable thermostats, and remind your employees to power down their computers. It’s like giving your expenses a power nap.

Review Insurance Premiums

Don’t let high premiums break the bank—explore other options for more competitive rates and higher deductibles. Shop around for better rates and consider raising deductibles. Who knows how much cash you could save in the process?

Negotiate With Vendors

Don’t be afraid to flex your negotiation muscles. Talk to your vendors about better terms and pricing options. Building strong relationships can lead to lower prices and better service. Everybody wins!

Audit Recurring Bills

Take a closer look at those recurring bills. Are they really worth it? If not, cancel unnecessary subscriptions and memberships. It’s like decluttering your expenses and giving your wallet some breathing room.

Take Advantage of Business Tax Breaks

The tax code has some hidden gems for entrepreneurs and small business owners. These tax breaks can give your cash flow a serious boost if you know how to use them.

Deductions for Home Office Use

If you’re doing work from your house, you could be able to subtract a part of your domestic outlays. It’s like getting a tax break while wearing your pajamas.

Tax Credits for Hiring Certain Employees

If you hire individuals from certain groups who have faced employment barriers, you could qualify for tax credits.

R&D Tax Credit

If you’re an innovation-focused company, check out the R&D tax credits. They reward businesses that engage in qualifying research activities.

To make the most of these opportunities, work with a qualified accountant and keep accurate records. Every dollar saved on taxes is a dollar that goes straight to your bottom line. Cha-ching.

Take Advantage of Business Tax Breaks

Boost your cash flow by cashing in on business tax breaks. They’ll reduce your taxable income and increase your net profits.

Tax Deductions for Small Businesses

The IRS offers a variety of tax deductions for small businesses. From home office expenses to vehicle costs, these deductions are like free money.

Section 179 Deduction

Get a major tax break with the Section 179 deduction. You can deduct the full purchase price of qualifying equipment. It’s like a shopping spree that saves you money.

R&D Tax Credit

If you’re in a field that values research and development, you could qualify for R&D tax credits. You’re basically getting rewarded for being innovative. How cool is that?

Savings With Qualified Business Income Deduction (QBI)

The QBI is a valuable tool introduced through The Tax Cuts and Jobs Act (TCJA). It can reduce your federal income taxes by 20%.

Credits for Hiring Certain Employees

Get rewarded for hiring certain employees with employment-related credits like the Work Opportunity Tax Credit (WOTC).

Don’t forget, there are also state-specific incentives available. But remember, while these tax breaks can boost your cash flow, they shouldn’t dictate how you run your business. They’re just tools to help you grow financially. Consult with professional advisors before making any decisions. Better safe than sorry.

FAQs About How to Build Cash Flow

How to Make Cash Flow Like a Boss

Looking to build cash flow? Here are some savvy strategies to get those dollar bills rolling in:

Tap Into Tax-Advantaged Retirement Accounts

Why wait until retirement to enjoy the benefits? Maximize your cash flow by taking advantage of tax-advantaged retirement accounts like a Roth IRA or a Solo 401(k).

Invest, Invest, Invest

Put your money to work for you. Seek out smart investment opportunities that can generate passive income and boost your cash flow.

Minimize Expenses, Maximize Profits

Cutting costs doesn’t have to be painful. Look for ways to trim unnecessary expenses and watch your cash flow soar.

Get Friendly With Business Tax Breaks

Don’t let the taxman take a big bite out of your cash flow. Familiarize yourself with the tax breaks available to entrepreneurs and make sure you’re taking full advantage.

Remember, building cash flow takes time and effort, but with the right strategies, you’ll swim in green in no time.

To build cash flow, you need strategy, smarts, and a sprinkle of luck.

By stashing your cash in tax-advantaged retirement accounts, you can watch your investments grow while giving Uncle Sam the slip. And don’t forget to spice things up by exploring different investment opportunities for a tastier return. Oh, and did we mention the beauty of passive income? It’s like money falling from the sky without you lifting a finger.

To keep the cash flowing, tighten those purse strings and cut costs wherever you can. And hey, why not take advantage of those sweet business tax breaks?

So, get your cash flow game on point and watch those dollar bills dance their way into your bank account.