Welcome to the second lesson in our new 4-part mini-course on The Map to Economic Independence!

As a quick reminder, Economic Independence (Point B on your map) is when you have enough cash inflows to support the lifestyle you want, without having to actively work…

So you can spend your time however you want, with whomever you want, and swing for fences when pursuing your passions.

In the first lesson, we showed you 5 keys to chart the most efficient course to Economic Independence, based on your unique situation.

It was focused on charting your path from where you are now to where you want to be, starting with YOU.

Now, in this lesson, we’re going to get a bit more tactical, and give you proven strategies to start seeing more cash flow in your life today…

Let’s get started:

Lesson 2: The Roadmap to Real Wealth

Each lesson in this mini-series has specific “key points” and action steps so you can start putting them into practice in your life now, and shave years — or even decades — off your journey to Economic Independence.

Key Teaching Points for Lesson 2:

Key #1: Plug Cash Flow Leaks With the 4 I’s

Key #2: Strategically Engineer Wealth With a Strong Foundation, Proper Safeguards, and Smart Growth

Highlights:

- It’s possible to reach Economic Independence in the next 3 – 7 years.

- If you’re deep in debt or have an expensive lifestyle, then you might take closer to 7 years.

- If your expenses are minimal and you implement these lessons quickly and effectively, you could do it in 3 years (or less)…

- Many people can get a 10% boost (or more) in their accessible cash flow, without budgeting (the average business owner finds $3,2791 with this process)

- The Cash Flow Index is the most powerful tool at your disposal to quickly pay down debt.

- You must build a rock-solid financial foundation to protect you and your family from economic downturns, financial predators, and wealth degradation over time in order to truly grow your wealth and legacy.

Action Steps are listed at the bottom of this lesson.

Key #1: Plug Cash Flow Leaks With the 4 I’s

How would you like to have an extra $500… $1,000, $2,000, or more in your bank account, each and every month, without working harder?

Well, the average small business owner is leaking $2,484 per month for absolutely no good reason.

Even if you’re not a business owner, 93% of people overpay on taxes. And many throw away money every month on inefficient insurance policies and investments.

In fact, with a few strategic moves, many people can get a 10% boost (or more) in your bottom-line income, without budgeting.

So, the first thing you want to do – no matter who you are or what you do – is plug every single cash flow leak. Because every dollar saved on a wasted expense goes straight to your bottom line. Not just today either… but every month moving forward.

Let’s start with…

Cash Flow Leak #1: Stop Tipping the IRS

When we work with new clients in our highest level FastTrack program, we regularly find up to $11,000 or more in tax savings just from overlooked items.

How?

Well, we have some pretty in-depth programs covering all of our tax-saving strategies in detail. And of course, we suggest you work with your accountant to see what’s best for your situation. But here are a few keys you can use today:

#1: Incorporate and Properly Allocate Your Income

- An LLC taxed as an S-Corp is a great fit for many small business owners producing $75,000 – $250,000 in profits per owner

- It offers liability protection and tax advantages including write-offs

- Allows you to pay yourself both a salary (as an employee) and distribution (as an owner), which saves you 15.3% on income earned through distributions

Note: you must pay yourself what the IRS would deem a “reasonable” salary based on your position.

#2: Maximize Deductions

Our tax resources program has a list of 300+ deductions, many of which may not have come up in your calls with your accountant. Here are a few common ones:

- Home office

- Cell phone

- Auto expenses

- Dining and entertainment (new rules allow 100% of restaurant food to be written off. Are you taking full advantage?)

- Travel

- Office supplies and technology (yes, you can depreciate your new macbook)

- Educational material (courses, masterminds, events)

#3: Use the “Augusta Rule”

- Named after residents of Augusta, GA, who rent out their homes for golf’s Masters tournament and earn up to $25,000 a weekend (and lobbied in the 1970’s to keep this income tax free)

- You can rent out your home for up to 14 days a year and pay zero taxes on that income

- If you own a business, you can rent your home to your business (and charge top fair-market value,) generating both a business expense that can be written off as well as tax-free income to you, personally

Note: this must be for a legitimate business reason, such as events, company training, networking, video shoots etc.

#4: Hire Your Kids

- This one is dead simple, but can save you a ton on taxes while empowering your kids with a go-get-em attitude at the same time

- As long as they’re doing legitimate work, you can hire your child and pay them up to $12,950 per year, tax-free

- If they stay under this limit, they usually don’t even have to file a tax return, which means they don’t pay any income tax on it. And you get to deduct their wages, which lowers your business’ taxable income

- You can hire your kids for modeling, creative feedback, janitorial duties, or any other task that you need done, and pay them the same rate you would pay any other employee

#5: Do a 3-Year Tax Review

- The IRS allows you to go back 3 years from the date you file the original tax return. So if you haven’t had a second opinion on your taxes in the last 3 years, now is the time to act

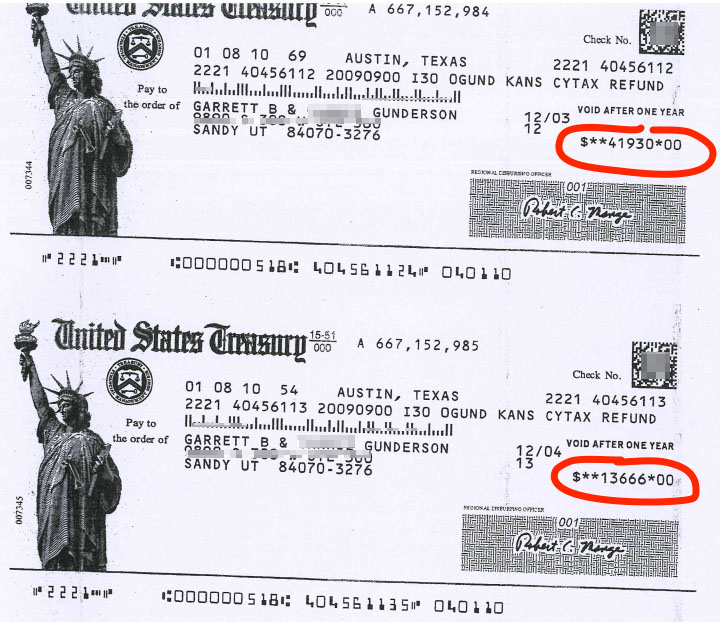

- Wealth Factory founder Garrett Gunderson got a second opinion from a tax attorney a few years ago and the result was two separate refund checks totaling over $55K2. Even if the amount you recover is only a couple thousand dollars, it’s always nice to get a little “bonus refund” you weren’t expecting

Cash Flow Leak #2: Optimize Your Insurance

This is possibly the single most boring topic in all of finance, so we’ll keep it brief:

- Find all of your policies and print them out or pull them up at the same time on your computer

- If you have any duplicate coverages, eliminate them

- Look into “umbrella” coverages. You might be able to get a lot more coverage than you have for the same amount or less

- Decide on your own insurance philosophy. Ours is to minimize premiums by only insuring the catastrophic. You will have higher deductibles if you make a claim (which should be rare), but you maximize cash flow which enables you to grow your wealth faster and reach Economic Independence sooner

Cash Flow Leak #3: Make Your Investments Cash Flow

This one is so important that even though we covered it in depth in Lesson 1, we’re going to repeat it again from a different angle.

The old model for building wealth = Money x Rate of Return x Time

The more money you have…

The higher the rate of return it earns…

And the longer you leave it invested…

The more you’ll have, “one day, some day.”

This optimizes your money for someone else — whoever convinced you to let them manage it. But not for YOU!

If you want to reach Economic Independence quickly, then you want to make it a top priority for your investments to cash flow. Use the Investment Cash Flow calculator process detailed in Lesson 1, and make it a priority to decide if you need to reconfigure your portfolio.

Cash Flow Leak #4: Pay Less Interest

The Cash Flow Index (CFI) is the most powerful tool at your disposal to quickly pay down debt and maximize your cash flow in the process. Here’s the formula:

CFI = Loan Balance / Minimum Payment

You’re looking for a high CFI number here. The higher the CFI, the more efficient the loan.

Keep in mind as you go through the process below that the interest rate doesn’t matter nearly as much as you might think it does… It’s just one part of the big picture.

Steps to paying down debt fast:

- Run the Cash Flow Index formula on all of your loans.

- Choose the loan with the lowest CFI score to tackle first (most inefficient for Cash Flow).

- Make minimum payments on all your other loans and redirect all the extra dollars to the one with the lowest CFI.

- Rank the remaining loans in order, from lowest score to highest.

Attack any other loans with a score under 50 next.

Consider restructuring loans with a score of 50-100.

Loans over 100 are pretty efficient and don’t need any special attention.

You might be able to refinance some of these loans as well to get a better interest rate and terms.

Celebrate your debt-reduction victories along the way. Be sure to put a percentage of your newly created cash flow into a “Living Wealthy account” and treat yourself.

Because the Wealth Factory way isn’t about sacrifice and delay, it is about living wealthy today.

A Few Examples:

Home Loan Balance: $230,000

Interest Rate: 5%

Monthly Payment: $1,665

Cash Flow Index: 137 ($228,000 ÷ $1,665)

Car Loan Balance: $16,000

Interest Rate: 7%

Monthly Payment: $450

Cash Flow Index: 37 ($16,500 ÷ $450)

Credit Card Balance: $13,000

Interest Rate: 13%

Monthly Payment: $260

Cash Flow Index: 50 ($13,000 ÷ $260)

In this example, tackle the Car Loan first (even though the credit card has a higher interest rate).

After the car loan is paid off, tackle the credit card next. You’ll have $450 extra per month (the old car loan) to pay down your credit card debt faster — and if you run into a financial pinch, you’ll have more options since you don’t have to use all $450 to pay down the credit card.

Key #2: Strategically Engineer Wealth

Now that you know how to stop cash flow leaks to free up more money, without budgeting or working harder…

It’s time to dive into what to do with that extra cash flow.

This is where the rubber really starts to hit the road, as we have a 3-part framework for strategically engineering wealth. It starts with:

#1: Build a Strong Foundation

Everyone will have a financial surprise sometime in their life. Some people will have multiple.

The question is, will you be prepared for that?… Because 95% of the time, it doesn’t have to be devastating (or even much more than a bump in the road.)

Here are a few things that you can quickly set up and start working towards, so you can sleep well at night knowing you have a rock-solid financial foundation… no matter what the economy or life throws at you:

Wealth capture account set up – this means automatically paying yourself first and automatically sweeping a set percentage of all your income into a separate account. You can start with any amount as long as you are consistent. We recommend you start with 15-18% and build from there. It’s about safety, liquidity, and accessibility so you can build a peace of mind fund and grow a little bit wealthier every day.

Value-based spending – when people are financially free, it means money is no longer the primary excuse or reason for doing or not doing something. They buy things based on the “value,” which is how you feel when you buy it. Lead with what you really want and pay cash for it. Just don’t borrow to consume.

Have a minimum of 6 months of savings in your peace of mind fund so you have staying power if there’s an issue of any kind. Even if that money doesn’t earn much of a return, it allows you to become a longer-term thinker and be more productive because of the peace of mind it grants you.

If you’ve ever been in a situation where you haven’t had enough cash on hand, then you start feeling a massive amount of stress. You might start taking on clients or projects you don’t want to, simply to make more money… or you wind up working late and then not sleeping. Liquidity gives you staying power and preserves your quality of life during rocky times.

Have 1 month of expenses in cash or precious metals in a safe at home. You can also have a digital wallet with crypto (Bitcoin, stablecoin etc.) if you’ve researched it well and it’s part of your Investor DNA.

Have a written investment and insurance philosophy, so you can focus. Because risk is in the investor, not the investment. Create some basic rules so it’s easy to know what to say yes and no to, such as focus over-diversification, cash flow over accumulation, and only investing in what you know.

#2: Maximize Your Safety & Security

The next step is to make sure you’re protected against catastrophic loss, financial predators, and wealth degradation over time. Here are few keys:

Underinsured / uninsured on an umbrella policy – what if someone hits you and they don’t have insurance? This means your policy covers you in that scenario. It’s one of the biggest bang for your buck things you can do. It ups your premium a bit, but it’s well worth it.

Irrevocable life insurance trust – this is money you’re not touching, and when you die the death benefit is no longer included in your estate, so you can avoid a lot of estate tax. But you can’t access your cash while you’re living. Now, an asset protection trust can give you some of the same benefits with less restriction, but these are expensive to set up so only look into them if you have a couple million dollars or more.

Statement of Purpose / Family Constitution. You have lessons learned, philosophies, core values and principles, and when you capture that and put it in your estate plan in your own words, it’s extremely valuable to help guide your heirs.

Board of Directors for your family trust. If you’re just starting out, this may be overkill and a lower priority. Our founder Garrett designated 5 people who could influence his kids positively if he’s not around. They’re not compensated while he’s alive, but if he dies they use his statement of purpose to help educate his kids.

If you’re a business owner, have a war chest or opportunity fund of 6 months. 50% of businesses will change hands in the next decade as Baby Boomers sell them. If you have cash, you can get a discount and take advantage of opportunities. Or a war chest is if you get attacked (the wealthier you become the bigger the target you are) or if any economic or financial storm comes up, you can weather it.

15% of your income into a wealth capture account. Use this to build liquidity first. Once you have 3-6 months’ worth of expenses built up as a “Peace of Mind” fund, then this can be put into your Cash Flow Bank and used to create more wealth. If you are unfamiliar with Cash Flow Banking, be sure to ask questions about it during the live Lesson 4 of this mini-series. We also have a course on this as well if you’re interested.

Protect the downside of your investments. Add a trailing stop loss or piece of collateral so you don’t have to participate in the entire downside. You can also do better due diligence to make sure you’re not getting into risky investments for YOU (because remember, risk is in the investor, not the investment.)

Get into lower stress investments. If you lose sleep about them, your health suffers and you’ll be less productive. You are your greatest asset, so it’s ok to say no. Many opportunities are actually distractions.

#3: Accelerate Growth

There are 2 ways to massively accelerate your growth when it comes to wealth building, and it comes down to Vision, which we talked about as well in Lesson 1.

It’s so important that it’s worth repeating because it truly is the rarest commodity in the world.

Vision is also the greatest deliverer of value in the world, and dollars follow value.

Most people think hard work constitutes value. Our founder, Garrett, comes from a coal mining family. He knows better than most that they work pretty darn hard.

But how many coal miners are extraordinarily wealthy?

Not many, right?

He likes to joke that it’s because they don’t have a lot of vision in there. Because it’s so dark in those caves, so vision is limited.

When you have a clear and powerful vision, all kinds of good things start to happen.

People become magnetized to you. They want to support you. Introduce you to their friends and other people who can support you.

You gain energy, and can more easily say “yes” or “no” to opportunities.

And the universe starts to present you with steps to get closer and closer to your vision.

It’s something you can’t currently achieve with your means, skills, and relationships. But it drives you to grow and acquire them so that you can bring it to life.

JFK saying “we’re going to land a man on the moon and return him safely home within this decade” was a powerful vision that united people, got them excited, and made them proud.

Our vision at Wealth Factory is to help 1 million people become economically independent, because when they do, they can be more impactful in their businesses, in their daily lives, in their charitable work.

What’s your vision?

As you ponder that, here are the 2 ways you can accelerate your growth…

The first is to understand and master your Investor DNA.

This means that you only invest in the things that you know. Keep it simple because – we’ll say it again – risk is in the investor, not the investment.

You need to understand how your investments benefit you today and in the future. With business, the more it’s able to perform without you, the better it is for you today and tomorrow.

Clarity and confidence in your financial direction means you’ll be more productive, think more abundantly, and enjoy life more along the way. You know what’s most important and what to do next.

Understanding your Investor DNA is a lifelong journey as we narrow down and focus on what we do best.

The second way is to Scale Business Revenue.

If you want to be truly wealthy, it’s all about owning a business. Because you can build something of value where you don’t have to be responsible for every little thing every minute. You can leverage an idea or vision because other people are willing to work for it.

Coming Next: Lesson 3 on The Wealth Architecture Blueprint

Now that we’ve covered the importance of charting your own path to Economic Independence…

And we’ve covered how to recover leaking cash flow…

Plus the roadmap to real wealth…

Our third lesson is focused on your Wealth Architecture Blueprint.

A big part of that is having a fully integrated financial team – attorneys, accountants, cash flow experts… everyone on the same page working to protect and grow your wealth.

In fact, this is why Wealth Factory began, because the wealthy have this. But what about everybody else?

That’s what’s up next in Lesson 3.

In the meantime, here are some questions to reflect on, as well as action steps to start implementing this lesson in your life.

You don’t have to do them all right now.

Rather, pick the most important questions and action steps for you. Maybe it’s something that inspired you. Or, maybe it’s something you’ve been putting off… that if you dealt with would free up a huge amount of mental space and energy?

Only you know what’s best… and only you can chart your unique path to Economic Independence. But you can bet we’ll be here every step of the way to help guide and support you.

Questions

- How can I minimize my taxes?

- Are my investments working hard for me and optimized for cash flow?

- Where do you need to focus most: financial foundation, security, or growth?

Action Steps

- Run all of your loans through the Cash Flow Index and make a plan for paying them down strategically.

- What’s the single most important thing you can do today to create more cash flow or protect and grow your wealth?

- Use the investment scorecard to rate your current investments. How well do they align?

Foot Notes:

- Based on survey data from clients in Wealth Factory’s top-tier Fast Track and Wealth Architecture programs. The survey was conducted in February of 2022 and is based on responses from 121 current and former members based on results they got with their program. Participants were part of the program at some point between 2014-2022.

- Garrett hired a tax attorney to perform a 3-year review his taxes and received 2 separate checks totaling $55,596.00: